20th Jan 2022. 7.44am

Regency View:

Morning Report – Thursday 20th January

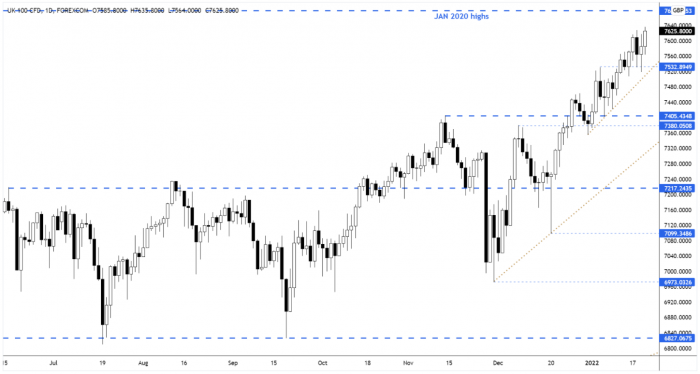

FTSE to open at 7,625 (+35 pts)

Asian shares are up considerably overnight as China cut its key mortgage rate for the first time in nearly two years…

The Hang Seng has surged more than 3% following the Peoples Bank of China’s decision to cut its interest rate to 3.7%.

This represents a clear divergence in monetary policy relative to other major central banks such as the Fed and BoE who are starting to hike rates.

| S&P 500 | -0.97% | Bearish for UK stocks |

| Hang Seng | +3.30% | Bullish for UK stocks |

| Gold | -0.02% | Neutral for UK stocks |

| AUD/JPY | +0.46% | Bullish for UK stocks |

| US 10yr Yield | -12pts | Neutral for UK stocks |

The FTSE bounced from the first support level we highlighted in yesterday’s Morning Report – the broken swing highs at 7,533.

It goes without saying that the markets reluctance to retrace too deep is clearly a bullish sign, and the FTSE’s New Year uptrend remains firmly back on track.

| Interim Results |

| Ilika (IKA) |

| Trading Announcements |

| AB Foods (ABF) |

| International Economic Announcements |

| 10:00 (EU) Consumer Price Index – Core (MoM)(Dec) |

| 13:30 (US) Initial Jobless Claims (Jan 14) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.