1st Jul 2021. 7.51am

Regency View:

Morning Report – Thursday 1st July

FTSE to open at 7,073 (+36 pts)

We continue to see a disconnect between Wall Street and the rest of the world, as the S&P edged to another high yesterday with Asia and Europe weakening.

This week’s PMI’s from Asia signal that rising costs and the COVID-19 delta variant are having a negative impact on Asia’s factory activity. Manufacturing grew at a slower pace in China and Japan, while activity shrank in Vietnam, Malaysia and India.

| S&P 500 | +0.15% | Neutral for UK stocks |

| Hang Seng | -0.57% | Bearish for UK stocks |

| Gold | +0.39% | Bearish for UK stocks |

| AUD/JPY | -0.14% | Neutral for UK stocks |

| US 10yr Yield | -0.35% | Neutral for UK stocks |

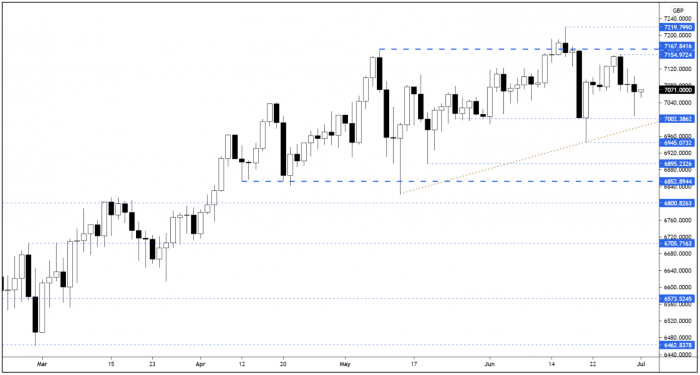

The FTSE didn’t quite test the 7,000 that we’d been targeting, but it got close and than rallied from lows – forming a bullish long-tailed candle.

Should the market break above yesterday’s highs during the opening rotations, it should set the tone for a strong session.

| Final Results |

| Ao World (AO.) |

| Argentex Group (AGFX) |

| Polar C. Hldgs (POLR) |

| Trading Announcements |

| AB Foods (ABF) |

| Cairn Homes (CRN) |

| Loungers Plc (LGRS) |

| Pz Cussons (PZC) |

| UK Economic Announcements |

| (09:30) PMI Manufacturing |

| International Economic Announcements |

| (08:55) PMI Manufacturing (GER) |

| (09:00) PMI Manufacturing (EU) |

| (10:00) Unemployment Rate (EUR) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

| (14:45) PMI Manufacturing (US) |

| (15:00) ISM Manufacturing (US) |

| (20:30) Auto Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.