17th Jun 2021. 7.46am

Regency View:

Morning Report – Thursday 17th June

FTSE to open at 7,138 (-46 pts)

US stocks beat a hasty retreat from all-time highs as the Federal Reserve brought forward plans for monetary tightening.

The US central bank upped its economic projections to factor in faster growth and higher inflation this year – penciling in two rate hikes in 2023 – sending stocks lower and the yield on the US 10yr surging higher.

Overnight, Asian stocks have fought back from early loses but there remains a bearish feel to our Risk Barometer and European stocks are called lower at the open.

| S&P 500 | -0.54% | Bearish for UK stocks |

| Hang Seng | -0.11% | Bearish for UK stocks |

| Gold | +0.17% | Bearish for UK stocks |

| AUD/JPY | +0.16% | Bullish for UK stocks |

| US 10yr Yield | +5.70% | Bearish for UK stocks |

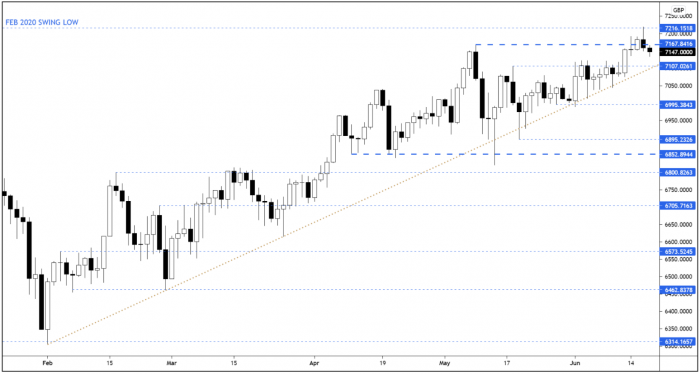

After a strong start to yesterday’s session which saw the FTSE touch the Feb 2020 swing lows at 7,216, the market fell back to close on intra-day lows – forming a bearish reversal candle.

This failure at resistance should setup a retest of the ascending trendline (gold dotted line) at the very least.

| Final Results |

| Halfords (HFD) |

| NextEnergy Solar (NESF) |

| Open Orphan (ORPH) |

| Record (REC) |

| Syncona (SYNC) |

| Volex (VLX) |

| Trading Announcements |

| Brown Group (BWNG) |

| Whitbread (WTB) |

| International Economic Announcements |

| (10:00) Consumer Price Index (EU) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Philadelphia Fed Index (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.