16th Sep 2021. 7.44am

Regency View:

Morning Report – Thursday 16th September

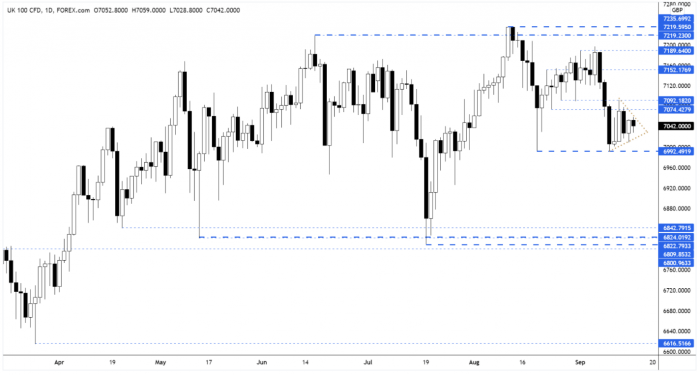

FTSE to open at 7,040 (+24 pts)

Wall Street rallied yesterday as Joe Biden met moderate U.S. Senate Democrats separately to discuss his $3.5 trln spending bill.

While overnight in Asia, Chinese stocks have continued to sell-off with the Hang Seng breaking to 10-month lows – Chinese property developers were hit the hardest.

| S&P 500 | +0.85% | Bullish for UK stocks |

| Hang Seng | -1.97% | Bearish for UK stocks |

| Gold | -0.47% | Bullish for UK stocks |

| AUD/JPY | -0.23% | Bearish for UK stocks |

| US 10yr Yield | +1.14% | Bullish for UK stocks |

Yesterday’s price action saw the FTSE print its smallest trading range in over seven sessions…

This compression has been building throughout the week, and should the market breakout from the wedge which is forming, we should see some directional follow-through.

| Final Results |

| Clinigen (CLIN) |

| Duke Royalty (DUKE) |

| Galliford Try (GFRD) |

| Kier (KIE) |

| Interim Results |

| Checkit (CKT) |

| Foresight Solar (FSFL) |

| Genincode (GENI) |

| Hilton Foods (HFG) |

| Keystone Law G. (KEYS) |

| Rtw Venture Fu. (RTW) |

| Q1 Results |

| Dx Plc (DX.) |

| Trading Announcements |

| C&c Grp (CCR) |

| International Economic Announcements |

| (10:00) Balance of Trade (EU) |

| (13:30) Continuing Claims (US) |

| (13:30) Retail Sales (US) |

| (13:30) Initial Jobless Claims (US) |

| (15:00) Business Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.