16th Jun 2022. 7.46am

Regency View:

Morning Report – Thursday 16th June

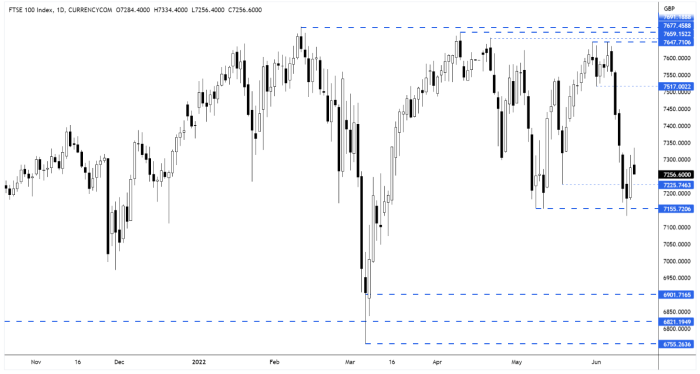

FTSE to open at 7,240 (-33 pts)

The Fed made its largest rate hike since 1994 yesterday, upping its benchmark policy rate by 0.75 percentage points to combat accelerating inflation.

Whilst tightening monetary policy is typically bearish for stocks, Wall Street rallied yesterday as Fed Chair Jay Powell said large rate rises would not be common in his press conference.

All eyes will now be on the Bank of England with Governor Andrew Bailey set to announce a fifth consecutive rate hike.

| S&P 500 | +1.46% | Bullish for UK stocks |

| Hang Seng | -1.29% | Bearish for UK stocks |

| Gold | -0.09% | Neutral for UK stocks |

| AUD/JPY | +0.35% | Bullish for UK stocks |

| US 10yr Yield | -166pts | Bullish for UK stocks |

The FTSE put in a strong thrust higher yesterday following Tuesday’s bounce from support.

For a bullish scenario to develop, the FTSE will need to at least hold near the top quartile of yesterday’s range.

| Final Results |

| Biffa (BIFF) |

| Halma (HLMA) |

| UK Economic Announcements |

| (11:00) Bank of England Minutes |

| (11:00) BoE Asset Purchase Facility |

| (11:00) BoE Interest Rate Decision |

| (11:00) Monetary Policy Summary |

| International Economic Announcements |

| (12:30) US Initial Jobless Claims (Jun 10) (USD) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.