14th Oct 2021. 7.49am

Regency View:

Morning Report – Thursday 14th October

FTSE to open at 7,188 (+47pts)

Wall Street climbed yesterday, despite a 5.4% rise in US consumer price data. This appears to have been largely priced in and markets were driven higher as investors sought out bargains, including technology stocks.

Asian shares were mostly up too, tracking the rally on Wall Street.

| S&P 500 | +0.30% | Bullish for UK stocks |

| Hang Seng | +0.00% (closed) | Neutral for UK stocks |

| Gold | -0.01% | Neutral for UK stocks |

| AUD/JPY | +0.44% | Bullish for UK stocks |

| US 10yr Yield | +2.23 | Bearish for UK stocks |

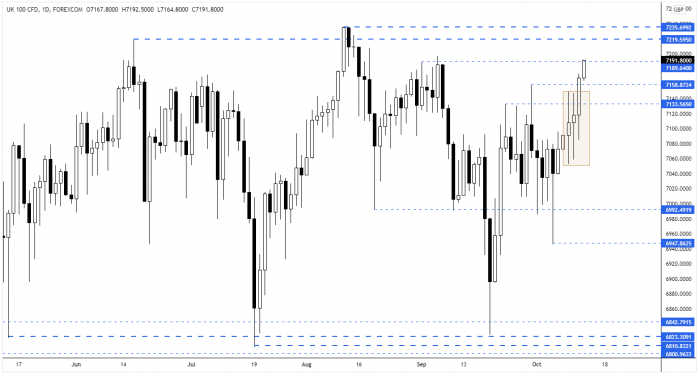

After a solid push higher on Wednesday, the FSTE broke through and then closed above short-term resistance at around 7,160.

Today looks it looks like we’ll see a retest of the high from early September, which will be the next key level to watch.

| Trading announcements |

| Dunelm (DNLM) |

| Hays (HAS) |

| Norcros (NXR) |

| Sabre Insur (SBRE) |

| Xps Pensions (XPS) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Producer Price Index (US) |

| (13:30) Continuing Claims (US) |

| (15:30) Crude Oil Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.