14th Jul 2022. 7.47am

Regency View:

Morning Report – Thursday 14th July

FTSE to open at 7,158 (+2 pts)

Stocks on Wall Street fell for a third consecutive session yesterday as US inflation data came in above expectations…

US consumer prices increased at an annual pace of 9.1% in June – reducing the probability that the Fed will ease off from its aggressive monetary tightening.

The hot US inflation data caused the dollar to reach parity against the euro for the first time in two decades. The strong dollar also weighed on Chinese stocks overnight with the Hang Seng remaining pinned to two-month lows.

| S&P 500 | -0.45% | Bearish for UK stocks |

| Hang Seng | -0.77% | Bearish for UK stocks |

| Gold | -0.64% | Bullish for UK stocks |

| AUD/JPY | +0.89% | Bullish for UK stocks |

| US 10yr Yield | -42pts | Bullish for UK stocks |

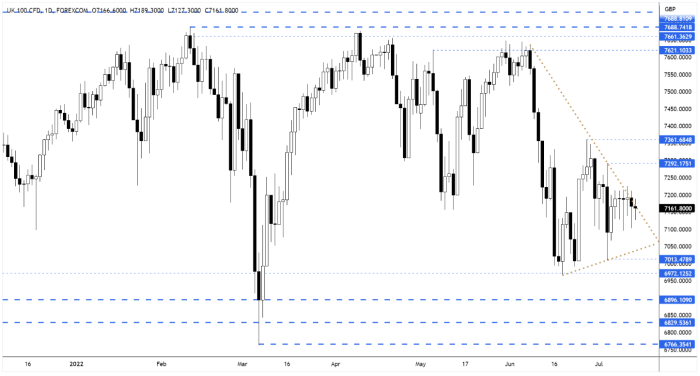

The increasingly small summer consolidation continued on the FTSE yesterday…

We’ve seen five consecutive small indecisive ‘doji’ style candles form – signalling that the market is coiling before a directional move.

| Final Results |

| Dsw Capital (DSW) |

| Trading Announcements |

| Hays (HAS) |

| Ashmore (ASHM) |

| Experian (EXPN) |

| Severn Trent (SVT) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

| (13:30) Producer Price Index (US) |

| (13:30) Continuing Claims (US) |

| (13:30) Initial Jobless Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.