12th May 2022. 7.43am

Regency View:

Morning Report – Thursday 12th May

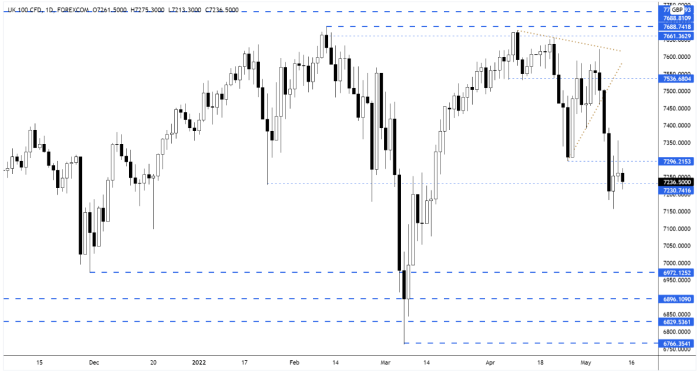

FTSE to open at 7,229 (-119 pts)

Yesterday’s stubbornly high US inflation data prompted a further sell-off in US stocks…

Headline US consumer prices rose 8.3% for the 12 months to April, slower than the 8.5% pace of a month earlier, but higher than market forecasts for 8.1% – prompting a -1.65% drop in the S&P 500.

Overnight, Asian stocks have mirrored the losses on Wall Street with the Hang Seng down more than -2% and the Nikkei 225 currently -1.77%.

This morning’s UK GDP number saw the UK economy shrink for the first time this year – output declined 0.1% from February compared with a forecast for no change.

| S&P 500 | -1.65% | Bearish for UK stocks |

| Hang Seng | -2.09% | Bearish for UK stocks |

| Gold | -0.05% | Neutral for UK stocks |

| AUD/JPY | -1.06% | Bearish for UK stocks |

| US 10yr Yield | -67pts | Bullish for UK stocks |

Yesterday’s price action saw the FTSE futures close well-below the cash market close – forming a bearish ‘pin-bar’ candle.

This pattern signals that we could see some downside continuation during today’s session.

| Interim Results |

| Grainger plc (GRI) |

| Titon (TON) |

| Trading Announcements |

| Balfour Beatty (BBY) |

| Interim Management Statement |

| Hargreaves Lansdown (HL.) |

| UK Economic Announcements |

| (06:00) Gross Domestic Product (QoQ)(Q1) PREL |

| International Economic Announcements |

| (12:30) Initial Jobless Claims 4-week average (May 6) (US) |

| (12:30) Producer Price Index ex Food & Energy (YoY)(Apr) (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.