11th Aug 2022. 7.44am

Regency View:

Morning Report – Thursday 11th August

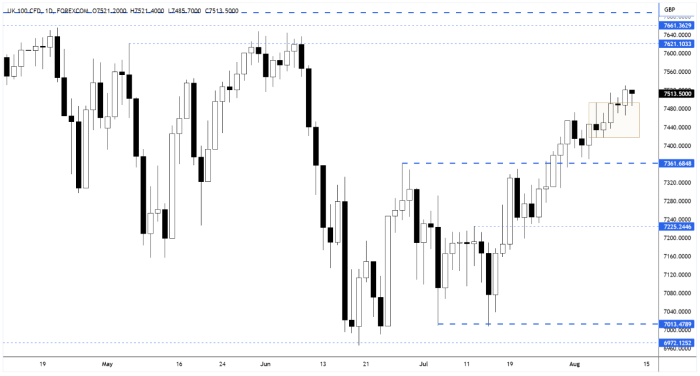

FTSE to open at 7,517 (+10 pts)

Yesterday’s US inflation data came in slightly below estimates, causing stocks on Wall Street to rally in anticipation of a more accommodative stance from the Fed.

US headline consumer prices rose 8.5% in July year-on-year, just shy of economists’ expectations of 8.7% – causing the S&P 500 to break above it’s May swing highs.

Asian stocks have followed Wall Street higher with Hong Kong’s Hang Seng index gaining more than 2%, erasing Wednesday’s losses.

| S&P 500 | +2.13% | Bullish for UK stocks |

| Hang Seng | +2.21% | Bullish for UK stocks |

| Gold | -0.31% | Bullish for UK stocks |

| AUD/JPY | +0.15% | Neutral for UK stocks |

| US 10yr Yield | +7pts | Neutral for UK stocks |

Yesterday’s price action saw the FTSE finally break and close above the inside day pattern, albeit in a slow and steady fashion.

The dominant momentum and market structure remains bullish.

| Interim Results |

| Network Intl (NETW) |

| Savills (SVS) |

| Derwent London (DLN) |

| Spirax-Sarco (SPX) |

| Empiric (ESP) |

| Pressure Tech (PRES) |

| Entain (ENT) |

| Empresaria Group (EMR) |

| Ocean Wilsons (OCN) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Producer Price Index (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.