10th Jun 2021. 7.49am

Regency View:

Morning Report – Thursday 10th June

FTSE to open at 7,089 (+8 pts)

Equities are treading water ahead of today’s ECB rate decision and policy statement.

Whilst European inflation is less than half that in the US, traders are still trying to calculate when the ECB will start tapering its bond buying programme.

Only minimal changes are expected by the market given Europe’s ongoing battle with the pandemic and the fragility of the recovery.

| S&P 500 | -0.18% | Bearish for UK stocks |

| Hang Seng | +0.18% | Bullish for UK stocks |

| Gold | -0.11% | Neutral for UK stocks |

| AUD/JPY | +0.06% | Neutral for UK stocks |

| US 10yr Yield | -2.66% | Bullish for UK stocks |

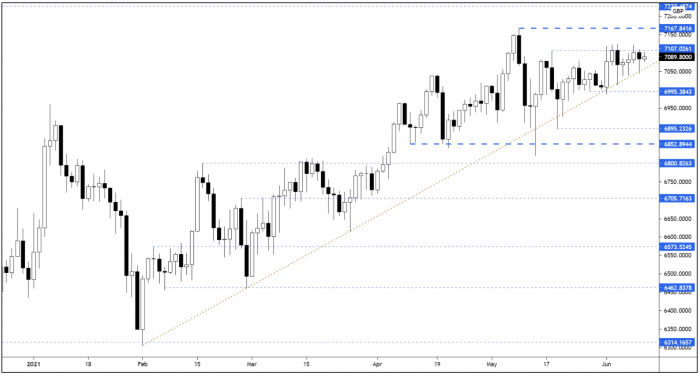

The FTSE continued to be compressed and funneled yesterday, with the market rallying from its long-term ascending trendline whilst respecting swing resistance.

It would appear that the market is gearing up for a burst of directional movement – given the uptrend and ‘ascending triangle’-type pattern which is forming, the probabilities are tipped in favour of the bulls.

| Final Results |

| Auto Trader (AUTO) |

| Card Factory (CARD) |

| Cmc Mkts (CMCX) |

| Halma (HLMA) |

| Jlen Env (JLEN) |

| Norcros (NXR) |

| Ted Baker (TED) |

| Trading Announcements |

| Itm Power (ITM) |

| UK Economic Announcements |

| (00:01) RICS Housing Market Survey |

| International Economic Announcements |

| (12:45) ECB Interest Rate (EU) |

| (13:30) Initial Jobless Claims (US) |

| (13:30) Consumer Price Index (US) |

| (13:30) Continuing Claims (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.