10th May 2021. 7.49am

Regency View:

Morning Report – Monday 10th May

FTSE to open at 7,151 (+21 pts)

US and European stocks reacted positively to Friday’s weak set of non-farm payrolls – indicating that investors are more concerned over rising inflation than the strength of the recovery.

The US labour market added just 266,000 jobs last month, well below consensus estimates of 978,000. The S&P broke to new highs on the back of the disappointing data, giving a clear signal of investors current mindset.

Our risk barometer has a distinctly bullish feel to it, with only gold’s recent rally a small sign that underlying risk aversion may be on the rise.

| S&P 500 | +0.77% | Bullish for UK stocks |

| Hang Seng | +0.55% | Bullish for UK stocks |

| Gold | +0.32% | Bearish for UK stocks |

| AUD/JPY | +0.58% | Bullish for UK stocks |

| US 10yr Yield | +0.34% | Neutral for UK stocks |

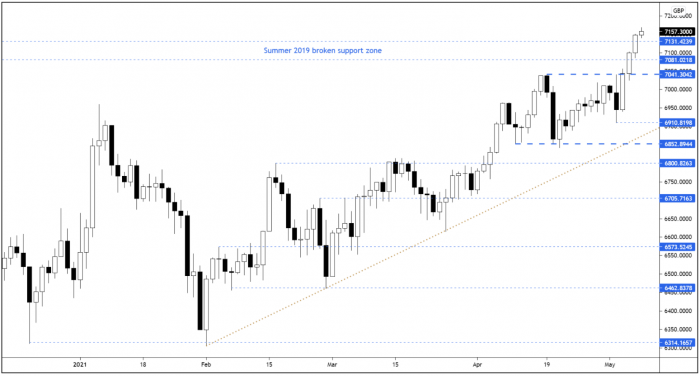

We’ve seen a strong breakout drive from the FTSE last week, with the futures even closing above the 2019 broken support / new resistance area.

At some point we are likely to see some mean reversion in the form of a pullback or consolidation phase. However, right now the market’s short-term momentum and long-term term trend are aligned in favour of the bulls.

| Q1 Results |

| HgCapital Trust plc (HGT) |

| UK Economic Announcements |

| (08:30) Halifax House Price Index |

| International Economic Announcements |

| (10:00) ZEW Survey (GER) – Current Situation |

| (10:00) ZEW Survey (EU) – Economic Sentiment |

| (10:00) ZEW Survey (GER) – Economic Sentiment |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.