8th Mar 2021. 7.47am

Regency View:

Morning Report – Monday 8th March

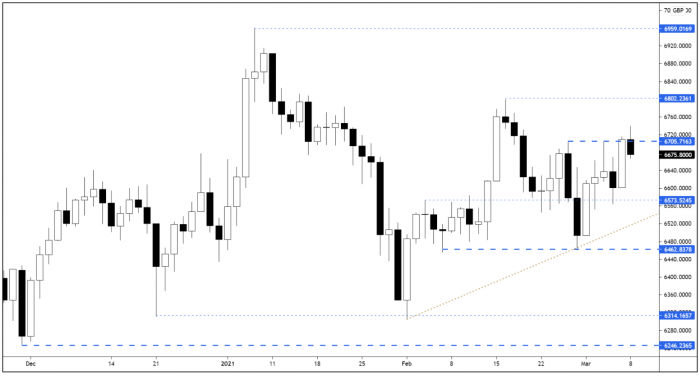

FTSE to open at 6,670 (+40 pts)

Friday’s Non-Farm payrolls came in miles ahead of market expectations with the US added 379k jobs in February versus consensus expectations of 182k.

The payrolls prompted a bounce in US stocks, especially in the tech sector, but in Asia traders have chosen to focus more on inflation worries as oil has jumped above $70 a barrel after attacks aimed at Saudi oil facilities.

| S&P 500 | +1.97% | Bullish for UK stocks |

| Hang Seng | -2.29% | Bearish for UK stocks |

| Gold | -0.01% | Neutral for UK stocks |

| AUD/JPY | +0.11% | Neutral for UK stocks |

| US 10yr Yield | +2.02% | Bearish for UK stocks |

The meat of Friday’s US payrolls rally came after the UK close at 4.30pm – hence the FTSE 100 futures closed well above the FTSE 100 cash index.

And whilst the futures have given back some of their Friday evening gains, the cash market is still set for a bullish open.

All eyes are on resistance at 6,705 – a level we highlighted last week. The futures have found resistance at that level overnight and if the FTSE consolidates below 6,705 during the opening rotation, it could setup a move down towards Friday’s lows.

| Final Results |

| Clarkson (CKN) |

| Direct Line (DLG) |

| Diversified Gas (DGOC) |

| Emis (EMIS) |

| Network Intl (NETW) |

| RHI Magnesita (RHIM) |

| Shoe Zone (SHOE) |

| Interims |

| Abcam (ABC) |

| Pci-pal (PCIP) |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (15:00) Wholesales Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.