7th Jun 2021. 7.47am

Regency View:

Morning Report – Monday 7th June

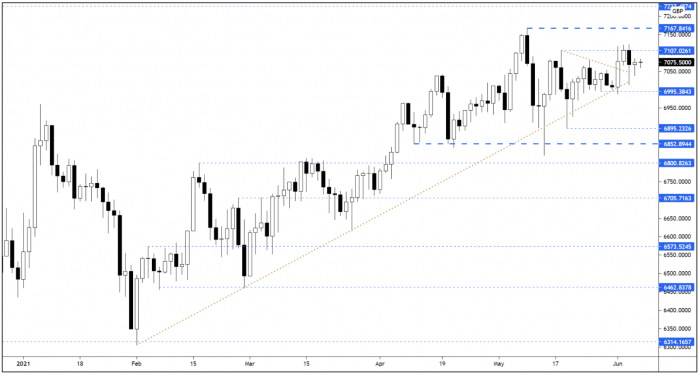

FTSE to open at 7,074 (+5 pts)

For the second month in a row, US non-farm payrolls came in below expectations…

559,000 new jobs were added in May, short of the market’s expectation of 650,000, but well up from the 278,000 recorded in April, which was revised from 266,000.

Reaction in the US was mildly bullish as fears that the Fed would be forced into a u-turn subsided – causing US bond yields to drop back.

Overnight in Asia, stocks were lower despite Chinese imports hitting a 10-year high with Hong Kong’s Hang Seng index down -0.62%.

| S&P 500 | +0.88% | Bullish for UK stocks |

| Hang Seng | -0.62% | Bearish for UK stocks |

| Gold | -0.43% | Bullish for UK stocks |

| AUD/JPY | -0.09% | Neutral for UK stocks |

| US 10yr Yield | -4.3% | Bullish for UK stocks |

The FTSE had an indecisive session on Friday – coiling within Thursday’s range and failing to follow the US higher.

In the short-term there appears to be minimal edge for bull or bear. However, the dominant medium-term uptrend tips the probabilities slightly in favor of the upside.

| Final Results |

| Sirius R E. (SRE) |

| Interim Results |

| Redx Pharma (REDX) |

| UK Economic Announcements |

| (08:30) Halifax House Price Index |

| International Economic Announcements |

| (07:00) Factory Orders (GER) |

| (20:00) Consumer Credit (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.