7th Feb 2022. 7.44am

Regency View:

Morning Report – Monday 7th February

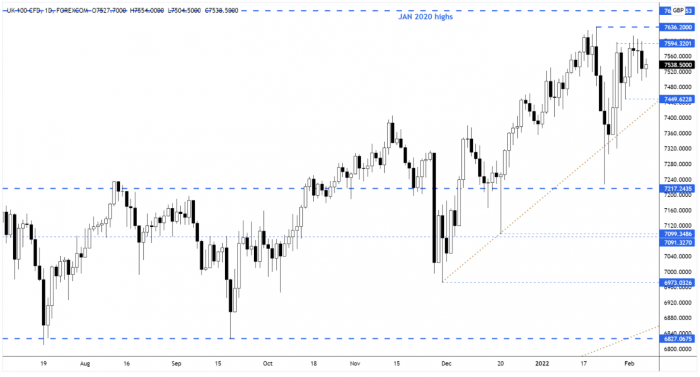

FTSE to open at 7,543 (+27 pts)

Friday’s US non-farm payrolls came in much strong than expected…

The January payrolls print was +467,000 versus an expectation of +150,000. And December payrolls were revised higher from +199,000 to +510,000.

This impressive jobs data has further increased expectations of aggressive rate hikes, causing US bond yields to rally on Friday and Asian stocks to slip overnight.

Looking ahead this week, there will be key data on US inflation and Germany’s production and trade figures. We also have the UK’s quarterly and monthly GDP estimates, published on Friday.

| S&P 500 | +0.52% | Bearish for UK stocks |

| Hang Seng | -0.11% | Bullish for UK stocks |

| Gold | +0.19% | Bearish for UK stocks |

| AUD/JPY | +0.35% | Neutral for UK stocks |

| US 10yr Yield | +80pts | Bullish for UK stocks |

Friday’s price action saw the FTSE retreat from short-term resistance and we’re set to open at the mid-way point of last week’s range.

With the market mid-range, there’s very little edge to be hand in the short-term, but it’s worth keeping in mind that the dominant technical structure remains bullish.

| UK Economic Announcements |

| (07:00) Halifax House Price Index |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (20:00) Consumer Confidence (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.