6th Jun 2022. 7.46am

Regency View:

Morning Report – Monday 6th June

FTSE to open at 7,595 (+62 pts)

Friday’s US nonfarm payrolls increased by 390,000 in May, above the 328,000 expected. While average hourly earnings rose slightly less than expected but were still up 5.2% from a year ago.

Stocks on Wall Street dropped back on Friday, but overnight in Asia the Hang Seng and Nikkei have started the week in bullish fashion.

Looking ahead this week, we have European GDP on Wednesday followed by an interest rate decision and policy statement from the ECB on Thursday, and US inflation data on Friday.

| S&P 500 | -1.63% | Bearish for UK stocks |

| Hang Seng | +1.49% | Bullish for UK stocks |

| Gold | +0.17% | Neutral for UK stocks |

| AUD/JPY | -0.17% | Neutral for UK stocks |

| US 10yr Yield | +30pts | Bearish for UK stocks |

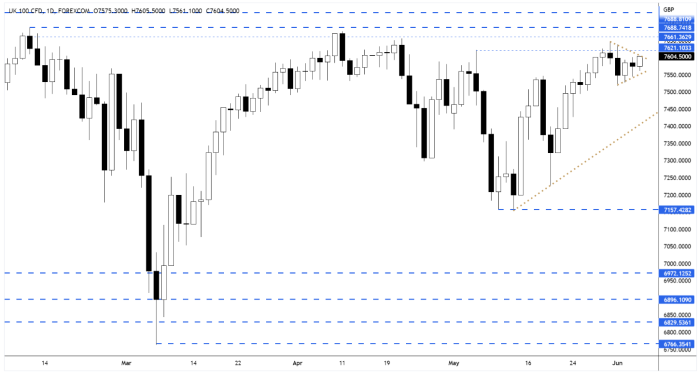

Price action on the FTSE futures during the Jubilee holiday period has seen the market coil and consolidate near recent highs, just underneath resistance.

A break to the upside will take the market up into a major area of resistance consisting of the February and April highs.

| UK Economic Announcements |

| (23:01) BRC Like-For-Like Retail Sales (YoY)(May) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.