6th Dec 2021. 7.45am

Regency View:

Morning Report – Monday 6th December

FTSE to open at 7,170 (+48 pts)

Friday’s non-farm payrolls came in well below expectations at +210,000 versus an expected increase of 550,000, but it is unlikely the weak data will change the Fed’s recent hawkish rhetoric.

Asian markets have moved lower overnight as trouble Chinese property developer Evergrande dropped 11% after saying there was no guarantee it would have enough funds to meet debt repayments.

Looking ahead this week inflation is front and center yet again, with Chinese CPI on Thursday and US CPI on Friday.

| S&P 500 | -0.84% | Bearish for UK stocks |

| Hang Seng | -1.64% | Bearish for UK stocks |

| Gold | +0.02% | Neutral for UK stocks |

| AUD/JPY | +0.54% | Bullish for UK stocks |

| US 10yr Yield | -6.79% | Bullish for UK stocks |

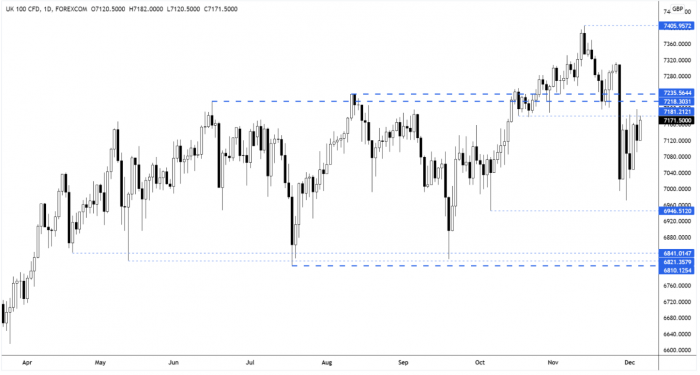

FTSE futures have moved higher overnight – taking the market back towards the key resistance zone we identified last week.

Having failed at the resistance zone on Friday, the bulls need the FTSE to close above Friday’s highs to break the whipsaw pattern that developed last week.

| Interim Results |

| Fusion Antibody (FAB) |

| International Economic Announcements |

| (07:00) Factory Orders (GER) |

| (09:30) PMI Construction |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.