5th Sep 2022. 7.47am

Regency View:

Morning Report – Monday 5th September

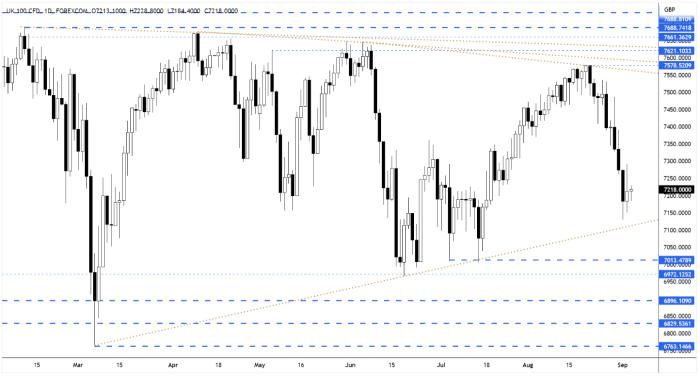

FTSE to open at 7,218 (-63 pts)

European gas prices have surged by almost a third in early trading today following Russia’s indefinite suspension of the Nord Stream 1 pipeline.

Overnight in Asia, stocks have weekended in Hong Kong as China extended lockdown in key cities ahead of its holiday season.

Looking ahead this week, we have a key OPEC+ meeting today in which Saudi Arabia are likely to push for a cut in oil production if prices keep falling.

We also have the UK’s Conservative party leadership election – with Liz Truss the clear favourite to become the next PM.

And on Thursday, the European Central Bank’s monetary policy committee meets to review how it can curb eurozone inflation.

| S&P 500 | -1.07% | Bearish for UK stocks |

| Hang Seng | -1.27% | Bearish for UK stocks |

| Gold | -0.13% | Neutral for UK stocks |

| AUD/JPY | -0.11% | Neutral for UK stocks |

| US 10yr Yield | -68pts | Bullish for UK stocks |

Friday’s price action saw the FTSE put in a relief rally following heavy losses throughout the week.

However, the market weakened during after hours trading and the FTSE is set to open lower.

| Final Results |

| Dechra (DPH) |

| Pci-pal (PCIP) |

| UK Economic Announcements |

| (09:30) PMI Services |

| (09:30) PMI Composite |

| International Economic Announcements |

| (08:00) OPEC+ Meeting (US) |

| (08:55) PMI Services (GER) |

| (08:55) PMI Composite (GER) |

| (09:00) PMI Composite (EU) |

| (09:00) PMI Services (EU) |

| (10:00) Retail Sales (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.