4th Oct 2021. 7.42am

Regency View:

Morning Report – Monday 4th October

FTSE to open at 7,026 (-1 pt)

Asian shares have had a bearish start to the week as concerns about China’s property sector and inflation worries offset last week’s upbeat US data and positive news on new drugs to tackle the pandemic.

Hong Kong’s Hang Seng index dropped more than 2% – taking prices back to their mid-September lows, and Japan’s Nikkei 225 was down more than 1% as prices continued to retreat from highs.

Looking ahead this week we have US factory orders this afternoon, British Chambers of Commerce quarterly economic survey on Wednesday and US non-farm payrolls on Friday.

| S&P 500 | +1.15% | Bullish for UK stocks |

| Hang Seng | -2.31% | Bearish for UK stocks |

| Gold | -0.10% | Neutral for UK stocks |

| AUD/JPY | -0.06% | Neutral for UK stocks |

| US 10yr Yield | -1.51% | Bullish for UK stocks |

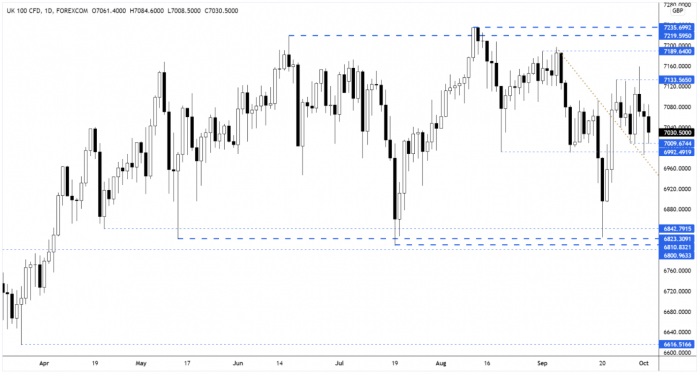

The FTSE appears to have formed a min-range from 7,000 to around 7,130 – mid-way between the long-term range at 6,835 – 7,235.

FTSE futures have moved to the bottom of the mini-range and the bulls will be looking for support to hold firm to maintain hope of a retest of the top of the long-term range.

| Final Results |

| Coral Products (CRU) |

| James Halstead (JHD) |

| Quadrise Fuels (QFI) |

| Annual Report |

| Redrow (RDW) |

| International Economic Announcements |

| (09:00) PMI Composite (EU) |

| (09:00) PMI Services (EU) |

| (15:00) Factory Orders (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.