4th Apr 2022. 7.45am

Regency View:

Morning Report – Monday 4th April

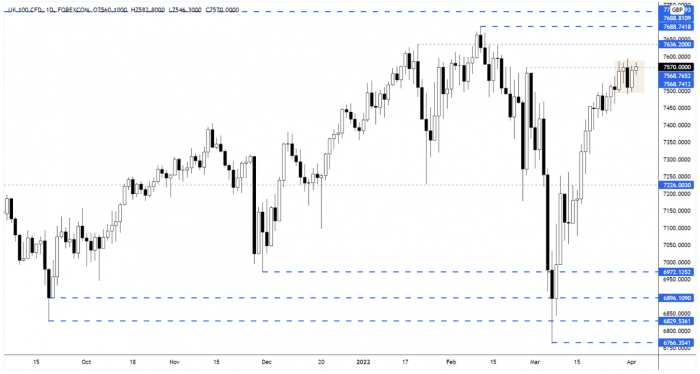

FTSE to open at 7,562 (+24 pts)

Friday’s headline non-farm payrolls number came in just below expectations at 431,000 versus 490,000 expected, but there were plenty of other positives…

February’s payrolls were revised even higher from 678,000 to 750,000, and the unemployment rate (3.6% Mar) and average hourly earnings (5.6% YoY Mar) came in ahead of expectations.

Overnight in Asia, the Hang Seng broke to a one-month high while Japanese stocks tread water.

Key economic events this week include; the publication of the minutes from the last Federal Reserve meeting on Wednesday, along with purchasing managers’ index data for Europe, Asia and the US throughout the week.

| S&P 500 | +0.34% | Bearish for UK stocks |

| Hang Seng | +1.89% | Bullish for UK stocks |

| Gold | -0.08% | Neutral for UK stocks |

| AUD/JPY | +0.37% | Bullish for UK stocks |

| US 10yr Yield | +41pts | Bearish for UK stocks |

The FTSE continues to coil within the ‘inside day’ range that we identified last week…

Friday’s price action saw the market bounce from the bottom of the mini-range and the market is now set to retest short-term resistance as we head into the opening bell.

| Final Results |

| Elixirr Int. (ELIX) |

| Belvoir (BLV) |

| Xpediator (XPD) |

| International Economic Announcements |

| (00:00) PMI Services (GER) |

| (07:00) Current Account (GER) |

| (07:00) Balance of Trade (GER) |

| (08:55) PMI Services (GER) |

| (10:00) Producer Price Index (EU) |

| (15:00) Factory Orders (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.