3rd Oct 2022. 7.47am

Regency View:

Morning Report – Monday 3rd October

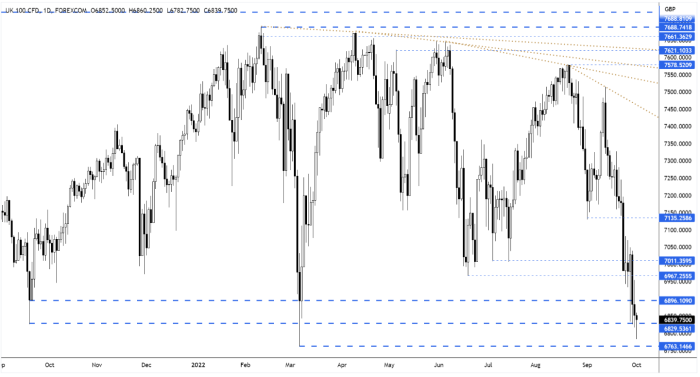

FTSE to open at 6,827 (-67 pts)

Friday’s price action on Wall Street saw the S&P 500 break and close below its June swing lows – taking the index to its lowest levels since November 2020.

Overnight in Asia, Chinese property stocks rose sharply in early trading following a series of supportive policies rolled out on Friday, as regulators seek to stem the property sector turmoil.

While the pound has edged higher as the UK chancellor is on the brink of abandoning his plans to abolish the 45p top tax rate.

| S&P 500 | -1.51% | Bearish for UK stocks |

| Hang Seng | -0.89% | Bearish for UK stocks |

| Gold | +0.28% | Bearish for UK stocks |

| AUD/JPY | +0.84% | Bullish for UK stocks |

| US 10yr Yield | +48pts | Bearish for UK stocks |

The FTSE has pressed down towards the March spike lows which formed in the immediate aftermath of the Russian invasion of Ukraine.

Below the March lows is a more than 400 point ‘pocket of air’ until the next support level – making this week’s price action very important!

| Final Results |

| Quadrise Fuels (QFI) |

| James Halstead (JHD) |

| Interim Results |

| Tortilla Mexic (MEX) |

| UK Economic Announcements |

| (09:30) PMI Manufacturing |

| International Economic Announcements |

| (09:00) PMI Manufacturing (EU) |

| (14:45) PMI Manufacturing (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.