3rd May 2022. 7.42am

Regency View:

Morning Report – Tuesday 3rd May

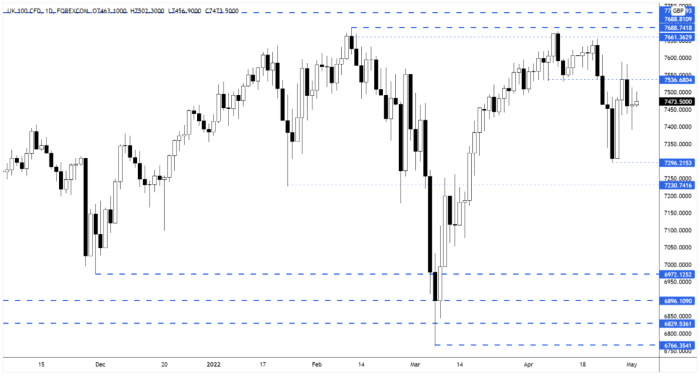

FTSE to open at 7,484 (-61 pts)

Yesterday’s price action on the S&P 500 saw the market bounce from the Feb 24th swing lows – forming a bullish hammer candle in the process.

While overnight in Asia, we’ve seen a quiet session with stocks in Japan and Hong Kong treading water ahead of the European opening bell.

Looking ahead this week, we have key interest rate decisions on both sides of the pond…

The Federal Open Market Committee kick things off on Tuesday, with the consensus of analysts forecasting a 50 basis point rate rise to 0.75% or 1.0%.

It’s the Bank of England’s turn on Thursday with analysts forecasting another 25 basis point hike.

| S&P 500 | +0.57% | Bullish for UK stocks |

| Hang Seng | +0.33% | Bullish for UK stocks |

| Gold | -0.12% | Neutral for UK stocks |

| AUD/JPY | +1.03% | Bullish for UK stocks |

| US 10yr Yield | +64pts | Bearish for UK stocks |

Friday’s price action indicated that the broken support level at 7,536, that was retested last week, has now become resistance.

The futures chart (below) includes yesterday’s price action, which we cannot read much into as the cash market was closed.

| Q1 Results |

| BP (BP.) |

| International Economic Announcements |

| (13:00) ECB’s President Lagarde speech (EUR) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.