30th May 2022. 7.47am

Regency View:

Morning Report – Monday 30th May

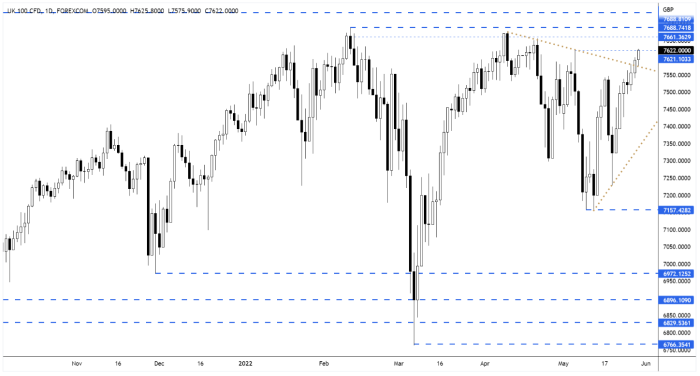

FTSE to open at 7,622 (+37 pts)

The S&P 500 ended last week on a strong footing after data showed that US consumer spending rose in April and the uptick in inflation slowed.

Overnight in Asia, stocks have jumped higher with the Hang Seng and Nikeei 225 both up more than +2% on the day.

Looking ahead in this shortened week for UK equity markets, there remains plenty of economic data to watch out for…

We have inflation and unemployment data for the eurozone countries, on Tuesday and Wednesday respectively, plus the Federal Reserve’s Beige Book on US economic conditions on Wednesday, and US non-farm payrolls on Friday.

| S&P 500 | +2.47% | Bullish for UK stocks |

| Hang Seng | +1.97% | Bullish for UK stocks |

| Gold | +0.49% | Bearish for UK stocks |

| AUD/JPY | +0.46% | Bullish for UK stocks |

| US 10yr Yield | -11pts | Neutral for UK stocks |

The FTSE has continued to climb higher – breaking above the descending line created by the series of lower swing highs that forming in April and May.

Volatility is starting to contract, with Friday’s daily range the smallest in over seven sessions – although this isn’t too surprising given that volumes are likely to be thin this week.

| International Economic Announcements |

| (12:00) Harmonized Index of Consumer Prices (YoY)(May) PREL (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.