27th Sep 2021. 7.46am

Regency View:

Morning Report – Monday 27th September

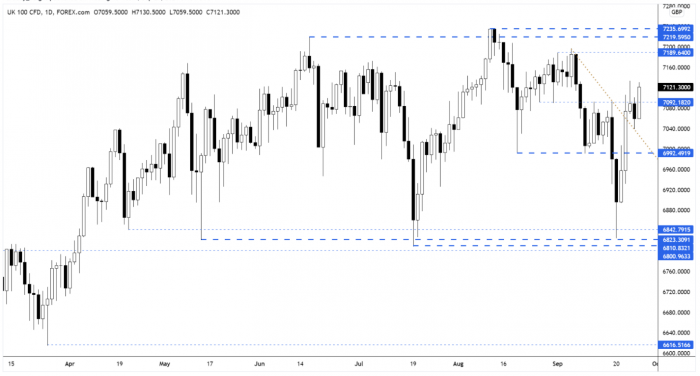

FTSE to open at 7,122 (+71 pts)

Fears of widespread contagion from China Evergrande Group’s debt troubles have receded and the Asian session has been relatively quiet.

However, there are increasing concerns that China’s supply shock will result in a shortage of goods for the Thanksgiving and Christmas shopping season – pushing up global CPI inflation.

It is also worth noting that today is the deadline for President Joe Biden’s $1tn infrastructure bill, which will be put to a vote in the House of Representatives. We’ll be keeping an eye on US-focused construction stocks such as CRH and Ferguson during European trading.

| S&P 500 | +0.15% | Neutral for UK stocks |

| Hang Seng | +0.52% | Bullish for UK stocks |

| Gold | +0.42% | Bearish for UK stocks |

| AUD/JPY | +0.16% | Neutral for UK stocks |

| US 10yr Yield | +1.57% | Bullish for UK stocks |

Friday’s retest of the broken descending trendline has been followed by a push higher in the futures as we head into the opening bell.

Thursday’s pin-bar highs may provide some resistance, but a strong close today would setup a rally towards the top of the range.

| Final Results |

| Oxford Cann (OCTP) |

| Interim Results |

| Fireangel (FA.) |

| Instem (INS) |

| Medica Group P. (MGP) |

| Microsaic (MSYS) |

| Minds+mach (MMX) |

| Octopus Renew. (ORIT) |

| International Economic Announcements |

| (09:00) M3 Money Supply (EU) |

| (13:30) Durable Goods Orders (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.