27th Jun 2022. 7.46am

Regency View:

Morning Report – Monday 27th June

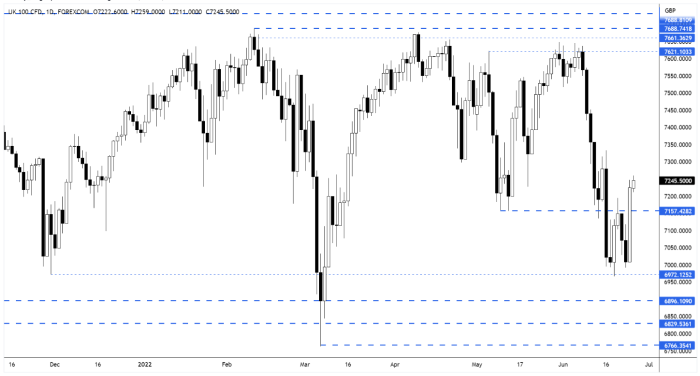

FTSE to open at 7,240 (+31 pts)

Wall Street ended last week on a high as stocks rallied more than +3% as signs of slowing economic growth and a recent pullback in commodity prices tempered expectations for the Fed’s rate-hike plans.

Overnight in Asia, Chinese and Hong Kong stocks rallied, with tourism and technology groups buoyed by Shanghai’s declaration of victory over Covid-19 – Shanghai recorded no new community cases of the virus for the first time in months.

Looking ahead this week, we have a raft of consumer confidence reports, inflation and gross domestic product updates – all likely to give some indication of the effectiveness of the various monetary policy tightening measures in play.

| S&P 500 | +3.06% | Bearish for UK stocks |

| Hang Seng | +2.06% | Bullish for UK stocks |

| Gold | -0.04% | Neutral for UK stocks |

| AUD/JPY | -0.18% | Neutral for UK stocks |

| US 10yr Yield | +41pts | Bearish for UK stocks |

Friday’s price action saw a strong, counter-momentum rally with prices closing near highs for the day…

Should prices hold above 7,157 in the the coming session, this could setup a more substantial rally back towards the 7,400 mid-range area.

| International Economic Announcements |

| (12:30) US Durable Goods Orders (May) |

| (12:30) Nondefense Capital Goods Orders ex Aircraft (May) |

| (18:30) ECB’s President Lagarde speech |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.