26th Jul 2021. 7.42am

Regency View:

Morning Report – Monday 26th July

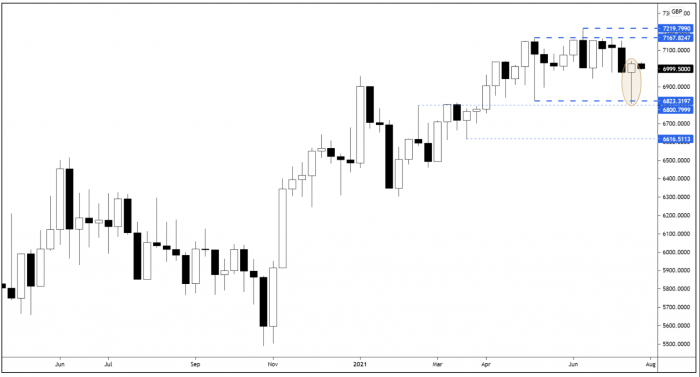

FTSE to open at 6,997 (-30 pts)

Chinese stocks have been hit hard overnight as a regulatory clampdown in Beijing spooked investors…

Hong Kong’s Hang Seng index, home to many of China’s largest stocks, tumbled to new lows for the year – it’s biggest daily decline in over eighteen months.

The sell-off was triggered after Beijing barred for-profit tutoring in core school subjects – sending Hong Kong-listed Scholar Education Group shares crashing more than 40% and sparking a strong sell-off across the education and property sectors.

The Asian sell-off overnight has taken the shine off Friday’s strong performance on Wall Street and we’re set for a cautious start to European trading.

| S&P 500 | +1.01% | Bullish for UK stocks |

| Hang Seng | -3.54% | Bearish for UK stocks |

| Gold | +0.19% | Bearish for UK stocks |

| AUD/JPY | -0.39% | Bearish for UK stocks |

| US 10yr Yield | -0.64% | Neutral for UK stocks |

We mentioned in Friday’s Morning Report that should the FTSE close above 6,960 the weekly candle chart would form a bullish ‘pin-bar’ or ‘hammer’ candle and that’s exactly what we’ve seen…

Viewing higher timeframes in this way can be a very useful tool for gaining perspective, and with the FTSE’s daily candle chart currently sitting mid-way between key support and key resistance, there’s plenty of value to be had by looking at the bigger picture on the weekly candle chart.

| Interim Results |

| Science Group (SAG) |

| Trading Announcements |

| Cranswick (CWK) |

| International Economic Announcements |

| (07:00) Import Price Index (GER) |

| (15:00) New Homes Sales (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.