26th Apr 2021. 7.40am

Regency View:

Morning Report – Monday 26th April

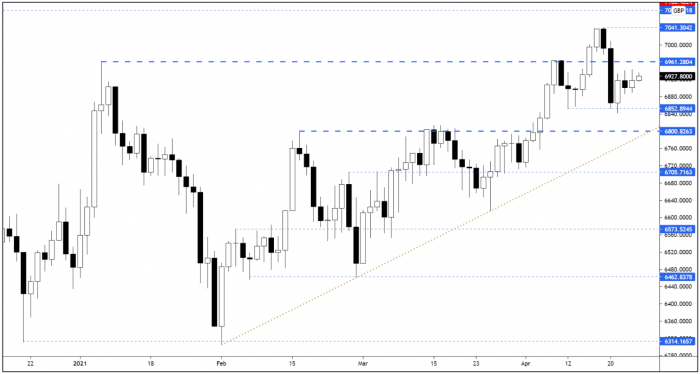

FTSE to open at 6,926 (-13 pts)

It’s been a quiet Asian session as traders look towards a busy week of key earnings and economic announcements…

We have the four US tech giants; Alphabet, Amazon, Facebook and Microsoft all reporting earnings this week. We also have all the major UK-listed banks reporting this week.

Alongside the raft corporate earnings, traders will be focused on Wednesday’s rate decision and policy statement from the US Federal Reserve. With long-term inflationary pressures increasing, the market will be looking for any hints that the Fed could start tapering its $120bn monthly asset purchase scheme.

| S&P 500 | +1.09% | Bullish for UK stocks |

| Hang Seng | -0.24% | Neutral for UK stocks |

| Gold | -0.14% | Neutral for UK stocks |

| AUD/JPY | +0.25% | Bullish for UK stocks |

| US 10yr Yield | +1.04% | Neutral for UK stocks |

The FTSE has continued to coil and consolidate just beneath the New Year highs.

Whilst the dominant trend structure remains bullish, the strength of last Tuesday’s sell-off means that dominant short-term momentum is bearish.

These conflicting technical factors leave us in coin flip territory, which is something traders should keep in mind when planning their trade setups today.

| Interim Results |

| Lock N Store (LOK) |

| International Economic Announcements |

| 12:30 US Durable Goods Orders (Mar) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.