24th May 2021. 7.37am

Regency View:

Morning Report – Monday 24th May

FTSE to open at 7,037 (+19 pts)

It’s been a quiet Asian session with the Hang Seng bouncing back from early-session lows, and Bitcoin steadying after being hammered last week on news of China’s crypto clampdown.

Looking ahead, it’s a big week for the US housing market, with April’s US New Home Sales and US Pending Home Sales hitting our screens on Tuesday.

We’ll also be watching to see if European economic sentiment increased in April, with German IFO Business Climate and the GfK Consumer Confidence readings.

| S&P 500 | -0.08% | Neutral for UK stocks |

| Hang Seng | -0.28% | Bearish for UK stocks |

| Gold | +0.17% | Neutral for UK stocks |

| AUD/JPY | -0.01% | Neutral for UK stocks |

| US 10yr Yield | -0.10% | Neutral for UK stocks |

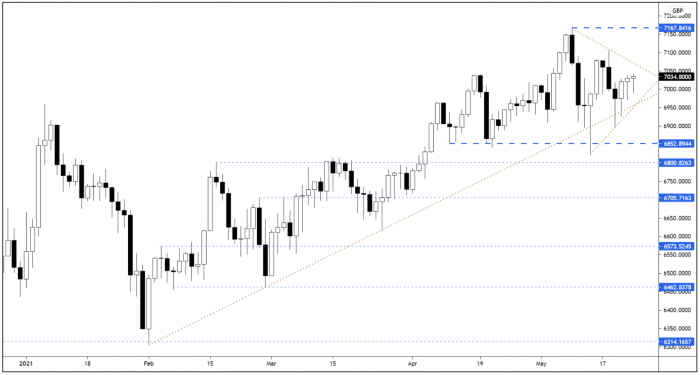

Volatility is starting to die off as the FTSE coils within the wedge pattern we identified last week…

Friday’s range was the smallest we’ve seen in over seven sessions, and this compression is likely to build potential for explosive directional price action in future sessions.

| Final Results |

| Kainos Group (KNOS) |

| Randall&quilter (RQIH) |

| International Economic Announcements |

| (07:00) Gross Domestic Product (GER) |

| (09:00) IFO Current Assessment (GER) |

| (09:00) IFO Expectations (GER) |

| (09:00) IFO Business Climate (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.