21st Jun 2021. 7.44am

Regency View:

Morning Report – Monday 21st June

FTSE to open at 6,978 (-39 pts)

Friday’s US and European stock sell-off followed through into Monday’s Asian trading with Japanese, Australian, South Korean and Hong-Kong listed stocks all deep into negative territory as the ‘reflation’ trade unravels.

Last Wednesday’s comments from the Federal Reserve indicated that it could raise rates to combat inflation sooner than expected – causing stocks and bond yields to move lower in unison.

This marks a step change in the market narrative away from inflationary concerns and towards a ‘taper tantrum’ as the traders price-in the impact of reduced monetary stimulus and two rate hikes in 2023.

| S&P 500 | -1.31% | Bearish for UK stocks |

| Hang Seng | -1.27% | Bearish for UK stocks |

| Gold | +0.69% | Bearish for UK stocks |

| AUD/JPY | +0.11% | Neutral for UK stocks |

| US 10yr Yield | -4.05% | Bearish for UK stocks |

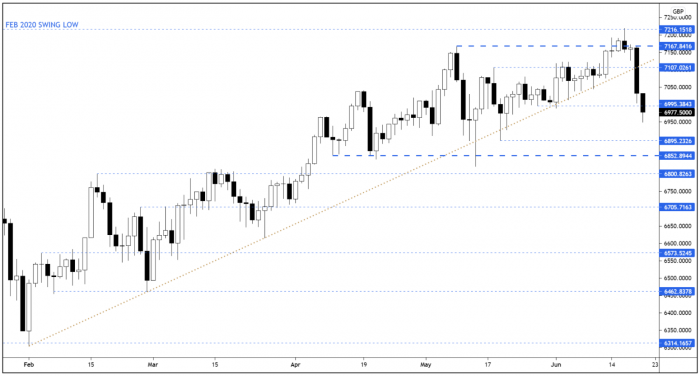

Friday’s price action saw the FTSE break decisively lower – snapping the ascending trendline which has been in place since February.

The short-term momentum dynamics of the market has changed in favour of the bears, and only a major bounce-back today would change that.

Downside targets for the FTSE come in at the cluster of swing lows which formed during April at 6,852.

| Final Results |

| Brndshld Sys (BRSD) |

| Sysgroup (SYS) |

| Annual Report |

| Tp Grp (TPG) |

| International Economic Announcements |

| (07:00) GFK Consumer Confidence (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.