20th Jun 2022. 7.48am

Regency View:

Morning Report – Monday 20th June

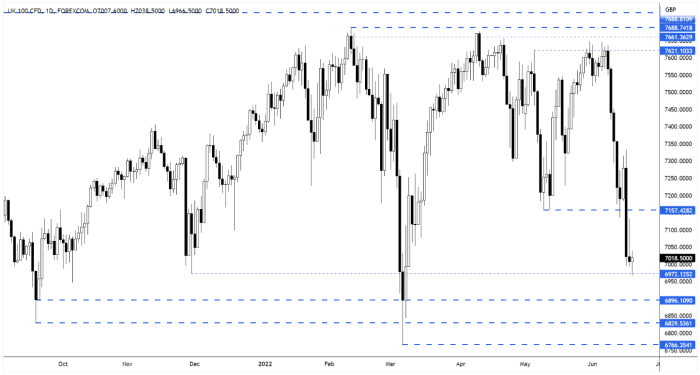

FTSE to open at 7,017 (+1 pt)

After Friday’s quiet session on Wall Street, we’ve had a quiet Asian session too.

The major moves have been on the crypto currency markets with Bitcoin falling below $20,000 over the weekend for the first time since December 2020. And there is growing concern that contagion from problems at key crypto players could unleash a shakeout if not contained.

Looking ahead this week, the key event will likely be Fed Chair, Jay Powell’s semi-annual appearance in front of the Senate banking, housing and urban affairs committee to give his monetary policy report.

| S&P 500 | +0.22% | Bullish for UK stocks |

| Hang Seng | +0.22% | Bullish for UK stocks |

| Gold | +0.10% | Neutral for UK stocks |

| AUD/JPY | +0.49% | Bullish for UK stocks |

| US 10yr Yield | +30pts | Bearish for UK stocks |

Friday’s bounce melted away into the cash market’s closing bell and the FTSE will start the week at 3-month lows.

We have a small support level created by the November swing lows at 6,972, but the major support levels come around the March swing lows.

| Trading Announcements |

| AB Foods (ABF) |

| International Economic Announcements |

| (06:00) European Producer Price Index (MoM)(May) (EUR) |

| (13:00) ECB’s President Lagarde speech (EUR) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.