1st Aug 2022. 7.47am

Regency View:

Morning Report – Monday 1st August

FTSE to open at 7,418 (-5 pts)

Stocks on Wall Street had a strong finish to last week as traders began to price-in the end of the Fed’s tightening cycle.

Overnight in Asia, stocks have made small gains despite Chinese factory activity in slowing more than analyst expectations in July.

Looking ahead this week, all eyes will be on the Bank of England as its Monetary Policy Committee weighs up how high to raise interest rates in order to bring inflation under control.

Governor Andrew Bailey has previously said an increase of half a percentage point is a possibility — which would be the biggest increase in 27 years.

| S&P 500 | +1.42% | Bullish for UK stocks |

| Hang Seng | +0.05% | Neutral for UK stocks |

| Gold | -0.18% | Neutral for UK stocks |

| AUD/JPY | -0.45% | Bearish for UK stocks |

| US 10yr Yield | -26pts | Bullish for UK stocks |

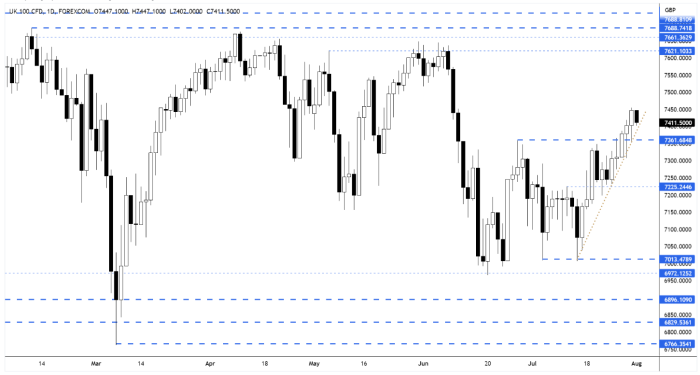

The FTSE closed last week above the swing resistance area that we’ve highlighted in previous reports.

This strong finish to the week opens the door for a push towards the 7,600 area.

| Interim Results |

| Hutchmed (HCM) |

| Spectris (SXS) |

| GlobalData (DATA) |

| RHI Magnesita (RHIM) |

| UK Economic Announcements |

| (09:30) PMI Manufacturing |

| International Economic Announcements |

| (07:00) Retail Sales (GER) |

| (08:55) PMI Manufacturing (GER) |

| (08:55) PMI Manufacturing (EU) |

| (10:00) Unemployment Rate (EU) |

| (14:45) PMI Manufacturing (US) |

| (15:00) Construction Spending (US) |

| (15:00) ISM Manufacturing (US) |

| (15:00) ISM Prices Paid (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.