19th Apr 2021. 7.55am

Regency View:

Morning Report – Monday 19th April

FTSE to open at 7,001 (-19 pts)

It’s been a quiet Asian session, with the Hang Seng hovering near two-week highs.

Traders will be heavily focused on the European Central Bank (ECB) this week, who will deliver their rate decision and policy statement on Thursday…

The ECB must decide whether they are doing enough to bolster an economy that is still being held back by lockdowns. In their last meeting, the ECB chose to conduct bond purchases “at a significantly higher pace” under its €1.85tn emergency pandemic programme and the market will be wanting more of the same.

| S&P 500 | +0.36% | Bullish for UK stocks |

| Hang Seng | +0.65% | Bullish for UK stocks |

| Gold | +0.11% | Neutral for UK stocks |

| AUD/JPY | -0.07% | Neutral for UK stocks |

| US 10yr Yield | -1.22% | Bullish for UK stocks |

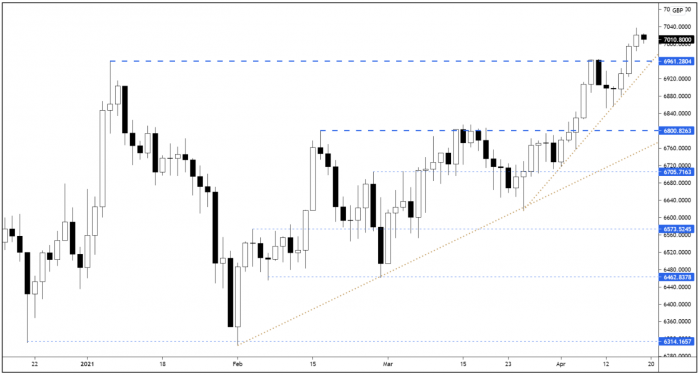

Friday’s steady positive session has significantly reduced the probability of a false breakout scenario…

Instead we are gearing ourselves towards the broken New Year highs, which now coincide with the ascending trendline, being used as support.

To find the next area of resistance on the FTSE’s chart, you need to zoom out and look back to 2019. During this period the market formed a cluster of swing lows just above 7,000 – creating a long-term base of support which was dramatically broken in the aftermath of the COVID-19 outbreak.

This broken support area may provide some resistance, but the dominant short-term structure on the FTSE is clearly bullish.

| Final Results |

| Churchill China (CHH) |

| International Economic Announcements |

| (09:00) Current Account (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.