18th Jul 2022. 7.41am

Regency View:

Morning Report – Monday 18th July

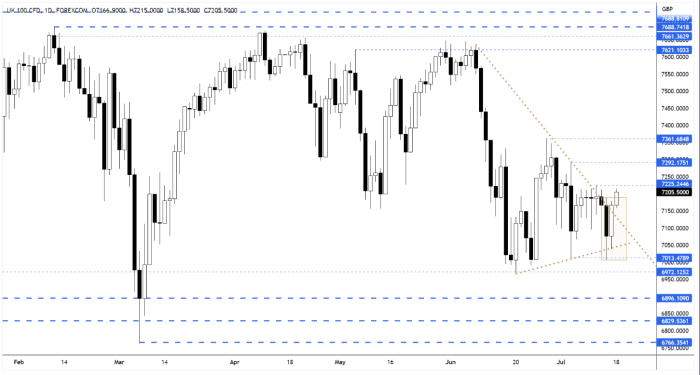

FTSE to open at 7,207 (+48 pts)

Asian stocks have rallied overnight, following Friday’s bounce on Wall Street…

The Hang Seng is currently trading more than 2% higher as a pullback in the US dollar triggered a relief rally in global equities on Friday.

Looking ahead, it’s likely to be a tense week for European equities as the ECB ponders further rate hikes and energy markets await the resumption of Russian gas flowing through the Nord Stream 1 pipeline on July 21. There is also growing political instability in Italy with Prime Minister Mario Draghi threatening to resign.

| S&P 500 | +1.92% | Bullish for UK stocks |

| Hang Seng | +2.45% | Bullish for UK stocks |

| Gold | +0.42% | Bearish for UK stocks |

| AUD/JPY | -0.04% | Neutral for UK stocks |

| US 10yr Yield | -43pts | Bullish for UK stocks |

Friday’s price action erased much of Thursday’s losses – forming an inside day pattern as the market remained contained within Thursday’s range.

This morning’s pre-open price action has seen the FTSE break above the the inside day pattern and should this hold during the opening rotation it would setup a bullish start to Monday’s trading.

| Interim Results |

| Audioboom Grp. (BOOM) |

| Trading Announcements |

| Tristel (TSTL) |

| Tortilla Mexic (MEX) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.