17th May 2021. 7.41am

Regency View:

Morning Report – Monday 17th May

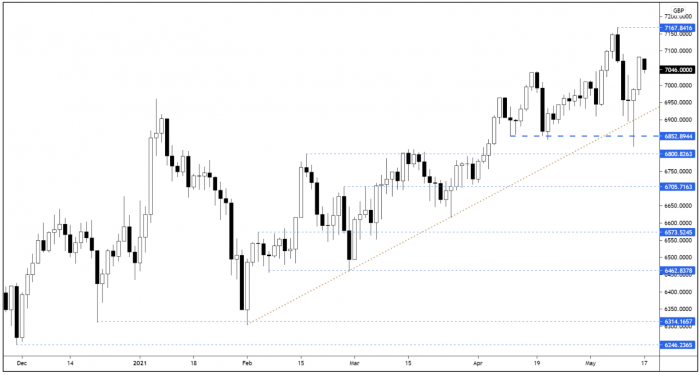

FTSE to open at 7,038 (-6 pts)

A mixed bag of Chinese economic data has seen European futures retreat from Friday’s highs…

Chinese retail sales rose 17.7% in April (year-on-year), below analyst estimates of 24.9%, while industrial production numbers matched expectations with a rise of 9.8%.

Our risk barometer is also painting a mixed picture, with a strong finish to last week from US stocks offset by gold hitting new highs for the month, indicating that risk aversion is increasing.

| S&P 500 | +1.49% | Bullish for UK stocks |

| Hang Seng | +0.58% | Bullish for UK stocks |

| Gold | +0.59% | Bearish for UK stocks |

| AUD/JPY | -0.36% | Bearish for UK stocks |

| US 10yr Yield | -2.06% | Bullish for UK stocks |

On Friday, the FTSE rallied strongly from Thursday’s bullish hammer candle, erasing over half the index’s losses for the week.

Should the market hold near Friday’s highs during the opening rotation, we could well see the market make a run for last week’s swing highs.

| Final Results |

| Petropavlovsk (POG) |

| Interim Results |

| Cerillion (CER) |

| Diploma (DPLM) |

| Hollywood Bwl (BOWL) |

| Q1 Results |

| Fondul Proprietatea (FP.) |

| Acron Regs (AKRN) |

| International Economic Announcements |

| (07:00) Wholesale Price Index (GER) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.