14th Jun 2021. 7.43am

Regency View:

Morning Report – Monday 14th June

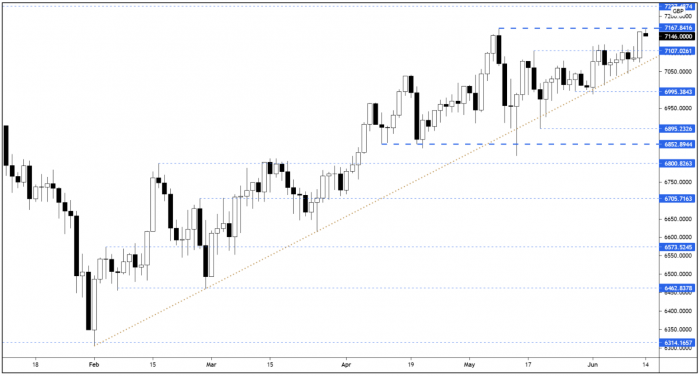

FTSE to open at 7,146 (+12 pts)

As Wall Street flirts with record highs again, all eyes will be on the Federal Reserve’s economic projections and monetary policy statement this Wednesday.

Asian stocks have been lifted by the last Friday’s bullish sentiment, but they continue to under-perform relative to the US and Europe, with the Hang Seng more than 7% below its February highs.

Our Risk Barometer has a distinctly bullish feel to it as we head into the European open.

| S&P 500 | +0.19% | Bullish for UK stocks |

| Hang Seng | +0.36% | Bullish for UK stocks |

| Gold | -0.88% | Bullish for UK stocks |

| AUD/JPY | +0.12% | Neutral for UK stocks |

| US 10yr Yield | +1.72% | Bearish for UK stocks |

The FTSE’s intense price compression that we highlighted last week came to an end on Friday with a strong surge higher – taking the maket up into its key May highs.

This is a key area of resistance, and with the futures already rejecting a first attempt to break through this morning, we’ll be watching price action at this morning’s open very closely.

| Final Results |

| Augmentum Fint. (AUGM) |

| Draper Esp (GROW) |

| Interim Results |

| Crest Nicholson (CRST) |

| Trading Announcements |

| Sthree (STEM) |

| International Economic Announcements |

| (10:00) Industrial Production (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.