13th Jun 2022. 7.46am

Regency View:

Morning Report – Monday 13th June

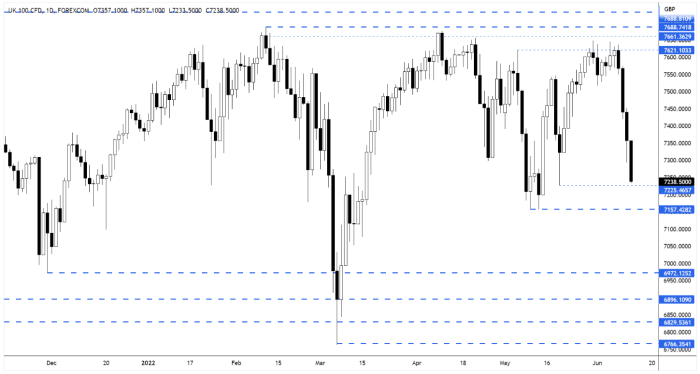

FTSE to open at 7,253 (-65 pts)

Friday’s US inflation data saw consumer prices accelerate at an annual pace of 8.6%, spooking global stock market’s…

The S&P 500 tumbled back towards its May lows as traders anticipate further monetary tightening when the Federal Market Open Committee meets this week.

Overnight in Asia, stocks have fallen sharply on the US inflation data and a new flare-up in COVID-19 cases in Beijing.

While this morning’s UK economic data came in below expectations with GDP shrinking -0.3% in April – marking the worst combination of surging prices and lack of economic expansion since the 1970s.

| S&P 500 | -2.91% | Bearish for UK stocks |

| Hang Seng | -3.46% | Bearish for UK stocks |

| Gold | -0.33% | Bullish for UK stocks |

| AUD/JPY | -0.01% | Neutral for UK stocks |

| US 10yr Yield | +116pts | Bearish for UK stocks |

After failing at resistance the FTSE ended last week in bearish fashion…

This bearish momentum has followed through into pre-open trading and the FTSE is set to open near the May 19th spike low (see chart below).

| UK Economic Announcements |

| (06:00) Gross Domestic Product (MoM)(Apr) |

| (06:00) Industrial Production (MoM)(Apr) |

| (06:00) Manufacturing Production (MoM)(Apr) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.