12th Apr 2021. 7.48am

Regency View:

Morning Report – Monday 12th April

FTSE to open at 6,893 (-22 pts)

Asian stocks have weakened overnight as we head into a big week for US bank earnings…

On Wednesday, we have earnings reports from JP Morgan Chase, Wells Fargo and Goldman Sachs, followed by Bank of America and Citigroup on Thursday, and Morgan Stanley and Bank of New York Mellon on Friday.

Also this week is US retail data which will indicate whether another round of stimulus payments that reached American households in March sent sales jumping again after they fell in February.

| S&P 500 | +0.77% | Bullish for UK stocks |

| Hang Seng | -0.96% | Bearish for UK stocks |

| Gold | -0.19% | Neutral for UK stocks |

| AUD/JPY | -0.20% | Neutral for UK stocks |

| US 10yr Yield | -0.63% | Neutral for UK stocks |

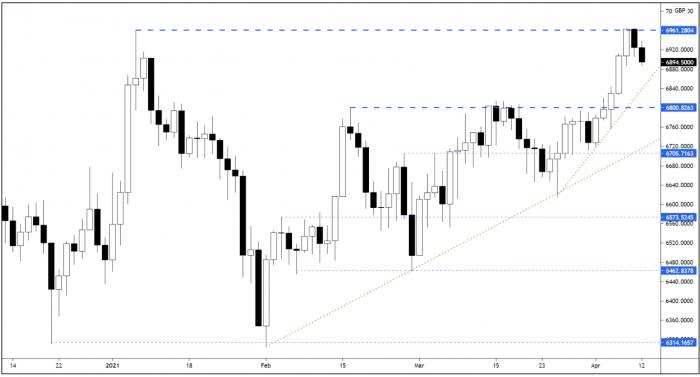

We mentioned in Friday’s Morning Report that selling pressure was likely to increase at the New Year highs and that’s exactly what we’ve seen…

The FTSE has been in retreat since the futures tested the highs on Thursday evening. However, trend structure and momentum remain firmly bullish, and we’d expect to see another attempt to break the highs at some point this week. The ascending trendline at 6,860 looks like a good approximation of where the markets next inflection point will be.

| Final Results |

| Belvoir (BLV) |

| Concurrent Technologies (CNC) |

| Elixirr Int. (ELIX) |

| Instem (INS) |

| Oxford Technology Venture Capital Trust (OXT) |

| Xpediator Plc (XPD) |

| Trading Announcements |

| Sirius R E. (SRE) |

| International Economic Announcements |

| (10:00) Retail Sales (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.