11th Jul 2022. 7.46am

Regency View:

Morning Report – Monday 11th July

FTSE to open at 7,111 (-85 pts)

Friday’s US jobs data came in ahead of expectations with 372,000 jobs added in June (versus 268,000 expected) and average hourly earnings up 5.1% year-on-year (versus 5% expected).

The jobs numbers received a muted reaction from Wall Street on Friday, but overnight in Asia stocks have moved lower in Hong Kong.

Looking ahead this week we have important inflation figures from the US, UK, France and Germany — possibly giving an indication of how long the cost of living crisis will last — plus GDP data from China and the UK.

We also have the start of US bank earnings season with JP Morgan Chase, Morgan Stanley, BNY Mellon and Citi Group reporting Q2 numbers towards the end of the week.

| S&P 500 | -0.08% | Neutral for UK stocks |

| Hang Seng | -2.98% | Bearish for UK stocks |

| Gold | -0.10% | Neutral for UK stocks |

| AUD/JPY | +0.12% | Neutral for UK stocks |

| US 10yr Yield | +88pts | Bearish for UK stocks |

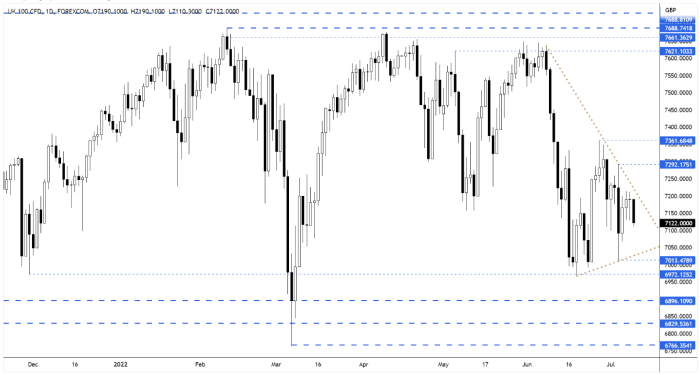

The FTSE’s recent price action has carved out a series of lower swing highs and higher swing lows – effectively ‘funneling’ prices towards the apex of a wedge pattern.

A break below Friday’s low during the opening rotation is likely to setup a retest of the bottom of the wedge.

| Final Results |

| Sequoia Economic Infrastructure Fund (SEQI) |

| Rua Life Sci. (RUA) |

| Trading Announcements |

| MJGleeson (GLE) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.