11th Oct 2021. 7.45am

Regency View:

Morning Report – Monday 11th October

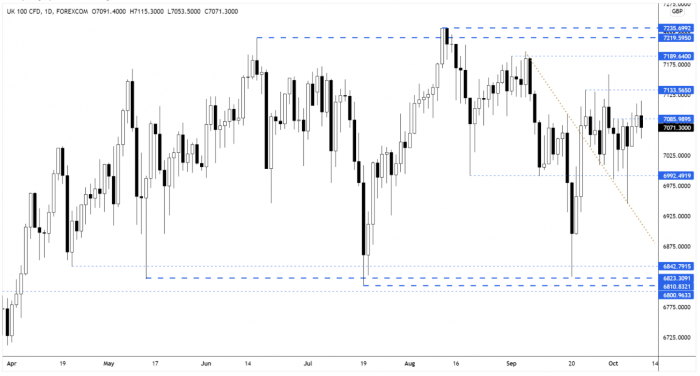

FTSE to open at 7,076 (-20 pts)

Friday’s non-farm payrolls came in unexpectedly lower with 194,000 jobs added to the US economy in September – below the 366,000 gains posted in August and well below the monthly average of 561,000 since the start of the year.

We mentioned in Friday’s non-farms preview that ‘only a very disappointing set of payrolls could force the Fed to question its tapering path’, and Wall Street bulls will be hoping Friday marked a tipping point.

This week, its the UK’s turn to lift the lid on its labour market with Tuesday’s Office for National Statistics monthly labour market statistics and Pay As You Earn data.

| S&P 500 | -0.19% | Neutral for UK stocks |

| Hang Seng | +1.85% | Bullish for UK stocks |

| Gold | -0.14% | Neutral for UK stocks |

| AUD/JPY | +0.78% | Bullish for UK stocks |

| US 10yr Yield | +3.69% | Bearish for UK stocks |

The FTSE managed to close just above short-term resistance on Friday. However, overnight the futures have rejected higher prices and are trading back below that short-term resistance level at 7,085.

It is worth reiterating that the market is currently mid-range and hence there is a high degree of randomness in its short-term price action.

| Trading Announcements |

| Xp Power (XPP) |

| UK Economic Announcements |

| (07:00) Manufacturing Production |

| (07:00) Gross Domestic Product |

| (07:00) Industrial Production |

| (07:00) Index of Services |

| (07:00) Balance of Trade |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.