9th Sep 2022. 7.39am

Regency View:

Morning Report – Friday 9th September

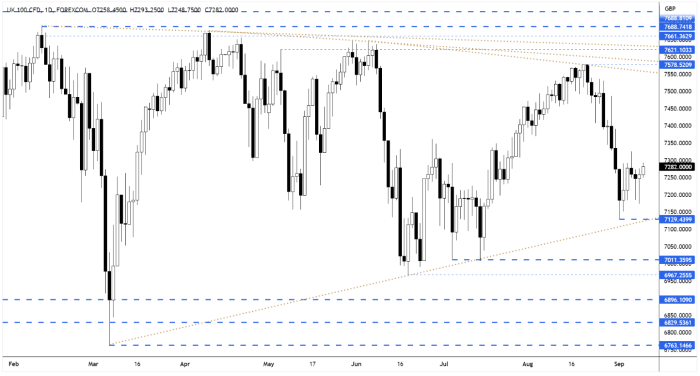

FTSE to open at 7,280 (+18 pts)

The UK has entered into a 10 day period of national mourning following the death of Queen Elizabeth II in Balmoral on Thursday.

In Europe, the ECB raised rates by 75 basis points yesterday, taking eurozone borrowing costs to their highest level since 2011…

Christine Lagarde, the ECB’s president, indicated there would be “several” rate hikes in the coming months to bring inflation down from its current 9.1% levels and back towards the bank’s target of 2%.

The US Federal Reserve joined the ECB in making hawkish comments yesterday, with chair Jay Powell doubling down on his Jackson Hole comments by stating that the US central bank needed to act “forthrightly” to ensure elevated inflation did not become entrenched.

Overnight in Asia, stocks in Hong Kong have recovered as investors continue to price in Beijing stimulus.

| S&P 500 | +0.66% | Bullish for UK stocks |

| Hang Seng | +2.77% | Bullish for UK stocks |

| Gold | +0.69% | Bearish for UK stocks |

| AUD/JPY | +0.33% | Bullish for UK stocks |

| US 10yr Yield | +54pts | Bearish for UK stocks |

The FTSE had a another flip-flopping indecisive session with prices rallying back from a lunch-time sell-off to close largely unchanged on the day.

As mentioned in yesterday’s Morning Report, this price action is indicative of a market in short-term equilibrium.

| Interim Results |

| Creo Medical (CREO) |

| UK Economic Announcements |

| (00:01) Retail Sales |

| (07:00) Balance of Trade |

| (07:00) Industrial Production |

| (07:00) Manufacturing Production |

| (07:00) Gross Domestic Product |

| (07:00) Index of Services |

| International Economic Announcements |

| (15:00) Wholesales Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.