9th Apr 2021. 6.52am

Regency View:

Morning Report – Friday 9th April

FTSE to open at 6,945 (+3 pts)

It’s been an undoubtedly bullish week for global equities with US and German stocks breaking to new highs, the UK market back at its highest level since the turn of the year, and Asian stocks bouncing from two-month lows.

A calmer bond market and weaker US dollar has certainly helped, so too has the continued dovish rhetoric from the Fed.

Our risk barometer is mildly bearish this morning and given the gains that we’ve witnessed this week, some profit taking into the weekend would be understandable.

| S&P 500 | +0.42% | Bullish for UK stocks |

| Hang Seng | -0.87% | Bearish for UK stocks |

| Gold | -0.26% | Neutral for UK stocks |

| AUD/JPY | -0.30% | Bearish for UK stocks |

| US 10yr Yield | +1.75% | Bearish for UK stocks |

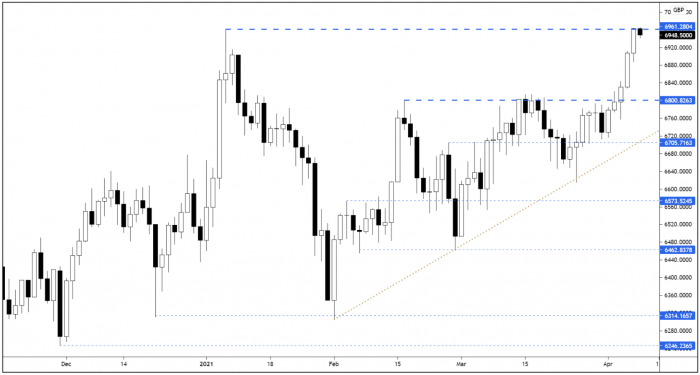

FTSE futures completed their retest of the New Year highs during the latter half of US trading.

The last time the FTSE touched these levels, a 600 point sell-off ensued during a three-week period. Whilst fears over Covid mutations are in a very different place to January, markets have a memory and these highs will no doubt attract some selling pressure.

| UK Economic Announcements |

| (08:30) Halifax House Price Index |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (07:00) Current Account (GER) |

| (07:00) Industrial Production (US) |

| (08:00) Balance of Trade (GER) |

| (13:30) Producer Price Index (US) |

| (15:00) Wholesales Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.