8th Oct 2021. 7.45am

Regency View:

Morning Report – Friday 8th October

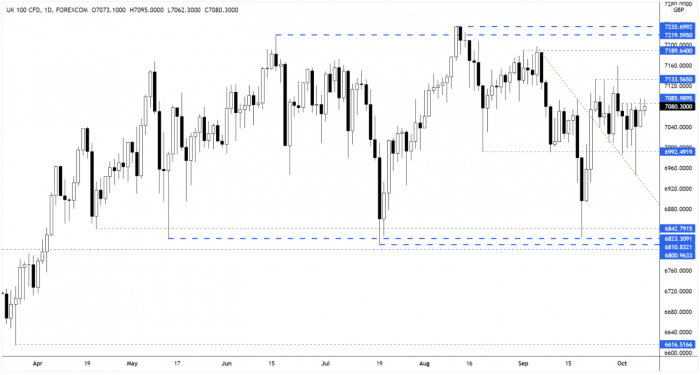

FTSE to open at 7,085 (+7 pts)

Wall Street continued its recovery rally yesterday, after the US Senate reached a deal on a stop-gap measure to extend the debt ceiling.

The proposed agreement increases the debt limit by $480bn – enough to kick the can down the road to early December.

All eyes are on today’s non-farm payrolls number and Regency members will receive a non-farm preview detailing the likely scenarios what it means for trading the S&P 500.

| S&P 500 | +0.83% | Bullish for UK stocks |

| Hang Seng | +0.20% | Neutral for UK stocks |

| Gold | +0.25% | Bearish for UK stocks |

| AUD/JPY | +0.10% | Neutral for UK stocks |

| US 10yr Yield | +3.41% | Bearish for UK stocks |

The FTSE held its ground yesterday in a relatively quiet session but could not close above the short-term resistance created by this weeks cluster of highs.

We expect volatility to increase with this afternoon’s non-farm payrolls release.

| International Economic Announcements |

| (07:00) Current Account (GER) |

| (07:00) Balance of Trade (GER) |

| (13:30) Unemployment Rate (US) |

| (13:30) Non-Farm Payrolls (US) |

| (15:00) Wholesales Inventories (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.