8th Jul 2022. 7.33am

Regency View:

Morning Report – Friday 8th July

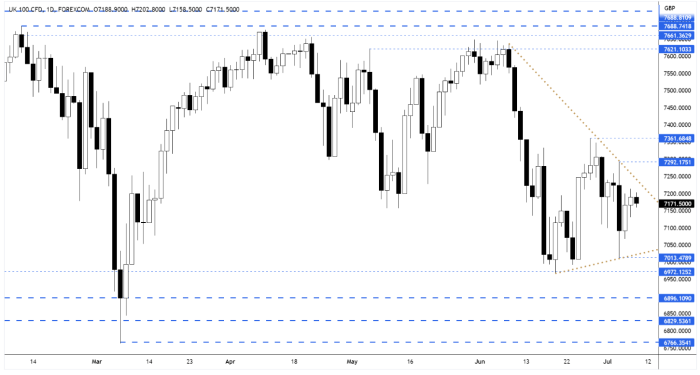

FTSE to open at 7,165 (-24 pts)

Wall Street rallied yesterday as traders balanced risks of a global slowdown with the potential for central banks to scale back their plans for interest rate rises.

While the pound actually strengthened following Boris Johnson’s resignation as Prime Minister. A new leader is expected to be chosen by September.

Overnight in Asia, stocks in Hong Kong remain subdued due to the strong US dollar. And stocks in Japan have had a volatile session after the former Japanese Prime Minister Shinzo Abe was shot while campaigning.

Looking ahead, we have June’s non-farm payroll numbers hitting our screens this afternoon and Regency account holders will receive our Non-Farm Payrolls Preview later this morning.

| S&P 500 | +1.50% | Bearish for UK stocks |

| Hang Seng | +0.27% | Bullish for UK stocks |

| Gold | +0.13% | Neutral for UK stocks |

| AUD/JPY | -0.39% | Bearish for UK stocks |

| US 10yr Yield | +65pts | Bearish for UK stocks |

Despite yesterday’s political hullabaloo, the FTSE held firm and continues to consolidate within Tuesday’s large bearish range.

| Final Results |

| Great Eastern (GEEC) |

| Trading Announcements |

| Ferrexpo (FXPO) |

| International Economic Announcements |

| (13:30) Nonfarm Payrolls (US) |

| (13:30) Unemployment Rate (US) |

| (15:00) Wholesales Inventories (US) |

| (20:00) Consumer Credit (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.