7th May 2021. 7.06am

Regency View:

Morning Report – Friday 7th May

FTSE to open at 7,103 (+27 pts)

UK stocks hit 14-month highs yesterday as the Bank of England upgraded its growth forecast.

The central bank now expects the UK economy to grow 7.25% this year, up from a previous forecast of 5% made three months ago and the highest rate in more than 70 years.

There is now a very present risk that the bank will overshoot it’s 2% inflation target this year. With this in mind, that banks Monetary Policy Committee said the pace of continuing bond purchases “could now be slowed somewhat”.

Traders on both sides of the Atlantic chose to focus on the positive economic forecast and the FTSE closed at its highest level since February 2020, and the S&P is back within touching distance of all-time-highs.

| S&P 500 | +0.82% | Bullish for UK stocks |

| Hang Seng | +0.21% | Neutral for UK stocks |

| Gold | +0.30% | Neutral for UK stocks |

| AUD/JPY | -0.04% | Neutral for UK stocks |

| US 10yr Yield | -0.34% | Neutral for UK stocks |

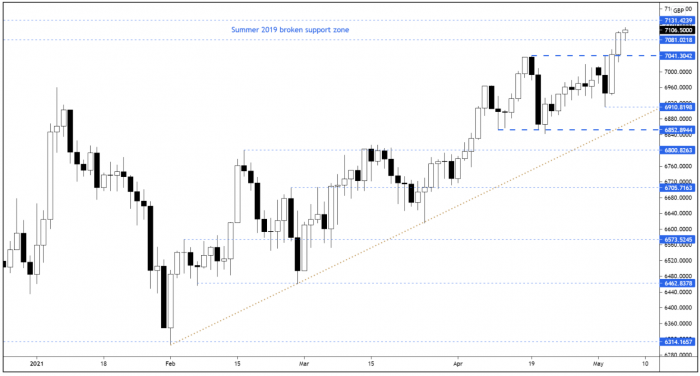

The FTSE broke and closed well above the April swing high resistance level we highlighted in yesterday’s Morning Report.

Prices have now pushed up into an area of potential resistance created the broken summer 2019 support area. Whilst you can’t see it on our chart below, it’s worth your while zooming out and looking left on your own FTSE chart.

Despite the potential resistance zone, momentum and trend are firmly bullish on the FTSE, and we’re likely to maintain a long bias to our trading portfolio.

| Interim Results |

| Numis (NUM) |

| Trading Announcements |

| InterContinental Hotels (IHG) |

| UK Economic Announcements |

| (09:30) PMI Construction |

| International Economic Announcements |

| (07:00) Balance of Trade (GER) |

| (07:00) Industrial Production (GER) |

| (07:00) Current Account (GER) |

| (13:30) Unemployment Rate (US) |

| (13:30) Nonfarm Payrolls (US) |

| (15:00) Wholesales Inventories (US) |

| (20:00) Consumer Credit (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.