6th May 2022. 7.26am

Regency View:

Morning Report – Friday 6th May

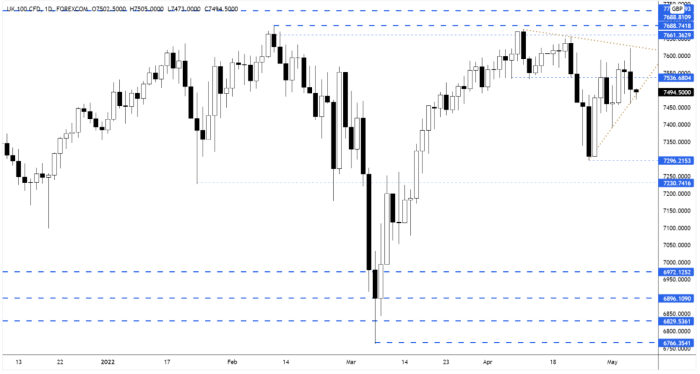

FTSE to open at 7,498 (-5 pts)

The Bank of England (BoE) warned yesterday that the UK economy will slide into recession this year as higher energy prices push inflation above 10% – a forecast that sent sterling to a two-year low.

While across the pond, the US ‘tech wreck’ kicked back into gear yesterday with the Nasdaq plunging -5% and the S&P 500 tumbling more than -3%.

Overnight in Asia, the Hang Seng has dropped back towards its April lows as China reinforced its zero-COVID policy which could hit growth hard.

Looking ahead, we have April’s non-farm payroll numbers hitting our screens this afternoon and Regency account holders will receive our Non-Farm Payrolls Preview later this morning.

| S&P 500 | -3.56% | Bearish for UK stocks |

| Hang Seng | -3.51% | Bearish for UK stocks |

| Gold | -0.11% | Neutral for UK stocks |

| AUD/JPY | +0.02% | Neutral for UK stocks |

| US 10yr Yield | +101pts | Bearish for UK stocks |

Yesterday’s price action saw the FTSE touch the top of the wedge and then retreat back to the bottom of the wedge on the BoE’s dour UK economic outlook.

We’ll be watching closely to see if the FTSE ends the week by breaking below the wedge.

| Trading Announcements |

| Beazley (BEZ) |

| Ted Baker (TED) |

| International Economic Announcements |

| (12:30) Nonfarm Payrolls (Apr) (US) |

| (12:30) Unemployment Rate (Apr) (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.