5th Nov 2021. 7.31am

Regency View:

Morning Report – Friday 5th November

FTSE to open at 7,262 (-18 pts)

The Bank of England caught traders off guard yesterday as the central bank refrained from hiking interest rates…

UK government bonds rallied sharply, while the pound tumbled 1.4% against the dollar to $1.34. And traders around the globe have been left wondering how high inflation needs to be before a major central bank will hike rates.

Overnight in Asia, Chinese large-cap stocks fell to a two-week low and Japanese stocks also weakened.

| S&P 500 | +0.42% | Bullish for UK stocks |

| Hang Seng | -1.54% | Bearish for UK stocks |

| Gold | +0.33% | Bearish for UK stocks |

| AUD/JPY | -0.15% | Neutral for UK stocks |

| US 10yr Yield | -4.96% | Bullish for UK stocks |

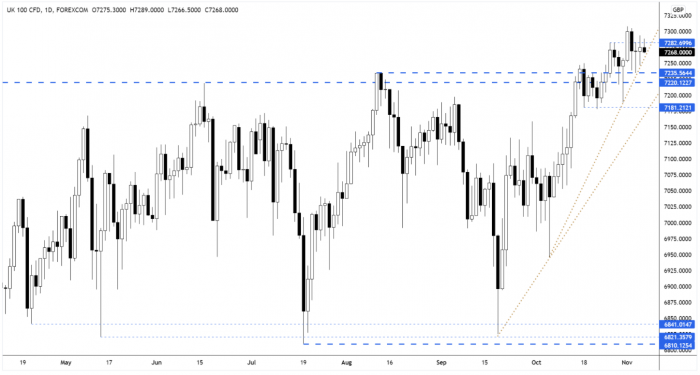

The FTSE responded in mixed fashion to the Bank of England’s lack of action – forming an indecisive ‘doji’ candle, just underneath last week’s highs.

As mentioned already this week, we need the resistance turned support zone at 7,220 to hold firm if we are to remain bullish in our short-term outlook.

| Interim Results |

| Kainos Group (KNOS) |

| Q3 Results |

| International Airlines (IAG) |

| Trading Announcements |

| Beazley (BEZ) |

| UK Economic Announcements |

| (07:00) Halifax House Price Index |

| International Economic Announcements |

| (07:00) Industrial Production (GER) |

| (10:00) Retail Sales (EU) |

| (12:30) Non-Farm Payrolls (US) |

| (12:30) Unemployment Rate (US) |

| (19:00) Consumer Credit (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.