4th Jun 2021. 7.27am

Regency View:

Morning Report – Friday 4th June

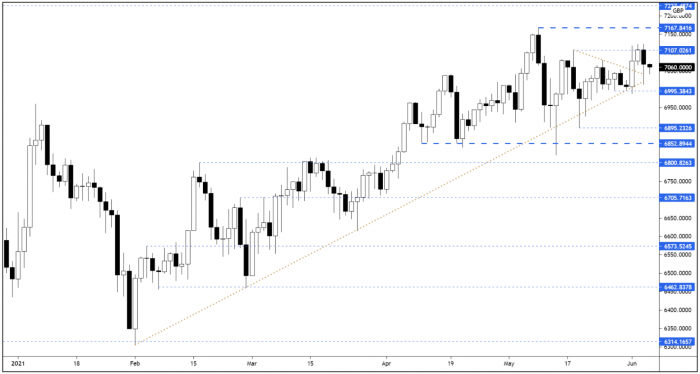

FTSE to open at 7,059 (-5 pts)

Big US tech stocks lead Wall Street lower yesterday, as economic data indicated that inflationary pressures were building…

The UN Food and Agriculture Organization’s monthly food price index saw global food prices surge by its highest amount in over a decade, and US initial jobless claims fell to a new low last week.

This data suggests that the Federal Reserve may be forced into scaling back monetary stimulus quicker than expected. It also increases the market’s tension heading into this afternoon’s non-farm payrolls number.

| S&P 500 | -0.36% | Bearish for UK stocks |

| Hang Seng | -0.44% | Bearish for UK stocks |

| Gold | -0.04% | Neutral for UK stocks |

| AUD/JPY | +0.02% | Neutral for UK stocks |

| US 10yr Yield | +2.01% | Bearish for UK stocks |

The FTSE retreated from the 7,107 swing resistance area faster than many would’ve expected given its strength earlier in the week.

However, the market did manage to fight back during the afternoon, and the the futures closed well above its morning lows – forming a bullish long-tailed candle as we head into today’s US non-farm payrolls.

| Annual Report |

| Block Energy P. (BLOE) |

| UK Economic Announcements |

| (09:30) PMI Construction |

| International Economic Announcements |

| (10:00) Retail Sales (EU) |

| (13:30) Unemployment Rate (US) |

| (13:30) Non-Farm Payrolls (US) |

| (14:00) Factory Orders (US) |

| (15:00) ISM Services (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.