3rd Dec 2021. 7.29am

Regency View:

Morning Report – Friday 3rd December

FTSE to open at 7,164 (+35 pts)

US stocks rebounded after a sharp drop late on Wednesday, but Wall Street’s so called ‘fear gauge’ signaled that investors expect further volatilty…

The Vix index that measures expected stock market volatility, traded at 28 on Thursday, above its long-run average of about 20.

While OPEC+ have decided to stick with a planned supply increase of another 400,000 b/d, despite the planned supply increase from the US.

Asian market’s have continued with the relief rally on Wall Street with stocks in Hong Kong up 1% ahead of today’s US non-farm payrolls data.

| S&P 500 | +1.42% | Bullish for UK stocks |

| Hang Seng | +1.00% | Bullish for UK stocks |

| Gold | +0.18% | Neutral for UK stocks |

| AUD/JPY | -0.30% | Bearish for UK stocks |

| US 10yr Yield | +3.20% | Bearish for UK stocks |

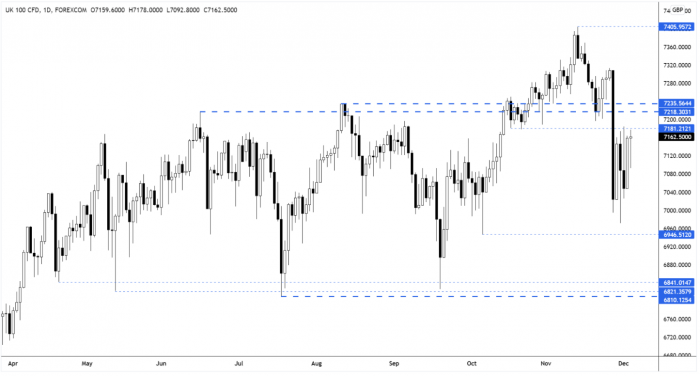

The FTSE pushed higher yesterday, but was contained within Tuesday’s range – forming an ‘inside day’ pattern.

In a range this pattern has very little edge and hence our focus is on the structure levels that we’ve annotated on the chart below.

| Final Results |

| Impax Asset Man (IPX) |

| Interim Results |

| Indust Reit (MLI) |

| Duke Royalty (DUKE) |

| Mind Gym Plc (MIND) |

| International Economic Announcements |

| (15:00) ISM Prices Paid (US) |

| (15:00) ISM Services (US) |

| (14:45) PMI Services (US) |

| (10:00) Retail Sales (EU) |

| (13:30) Unemployment Rate (US) |

| (08:55) PMI Composite (GER) |

| (14:45) PMI Composite (US) |

| (15:00) Factory Orders (US) |

| (08:55) PMI Services (GER) |

| (09:00) PMI Services (EU) |

| (13:30) Non-Farm Payrolls (US) |

| (09:00) PMI Composite (EU) |

| (09:30) PMI Services |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.