31st Dec 2021. 7.28am

Regency View:

Morning Report – Friday 31st December

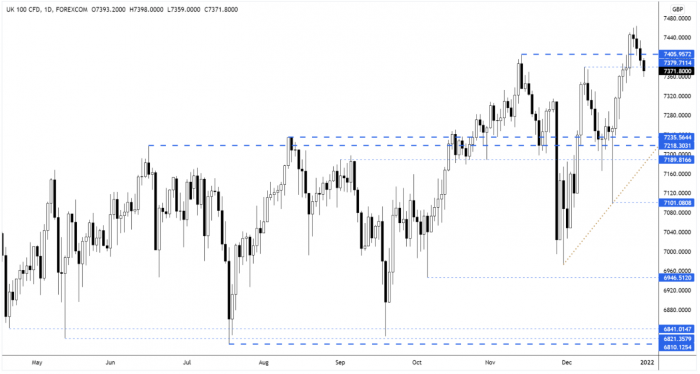

FTSE to open at 7,370 (-33 pts)

Wall Street failed to hold onto its early session gains yesterday, closing near lows for the session as COVID-19 cases hit record highs in 20 different countries.

The World Health Organization has warned of an impending “tsunami” of infections as the highly transmissible coronavirus variant and the Delta strain circulate together.

Overnight, Asian stocks have bounced China’s factory activity unexpectedly accelerated in December. The official manufacturing Purchasing Managers’ Index (PMI) rose to 50.3 from 50.1 in November, data from the National Bureau of Statistics (NBS) showed.

| S&P 500 | -0.30% | Bearish for UK stocks |

| Hang Seng | +1.24% | Bullish for UK stocks |

| Gold | +0.27% | Bearish for UK stocks |

| AUD/JPY | +0.23% | Bullish for UK stocks |

| US 10yr Yield | -2.74% | Bullish for UK stocks |

The FTSE closed back below the November swing highs during yesterday’s session, signalling the market’s reluctance to maintain its breakout on thin festive volumes.

However, the pullback from highs has been low volatility in nature and this is a bullish sign which reduces the probability of a major ‘fakeout’ reversal pattern taking shape.

| Interim Results |

| Trading Announcements |

| International Economic Announcements |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.