30th Sep 2022. 7.40am

Regency View:

Morning Report – Friday 30th September

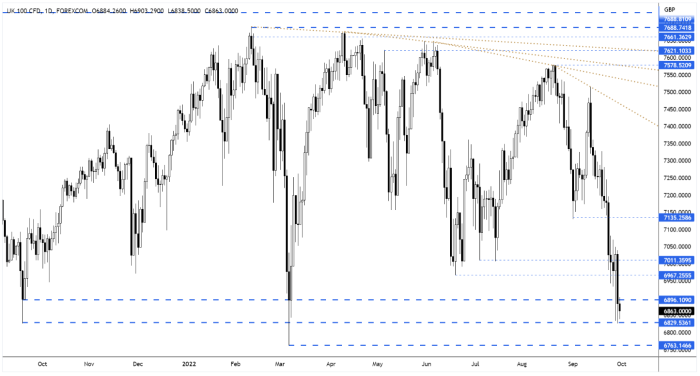

FTSE to open at 6,868 (-14 pts)

Wall Street ended sharply lower on Thursday as investors fretted about volatility in global currency and debt markets.

While in Europe, German inflation soared to double-digit levels for the first time in more than 70 years.

Overnight in Asia, South Korea’s chip production declined for the first time in more than four years as chipmakers are facing slowing global demand.

| S&P 500 | -2.11% | Bearish for UK stocks |

| Hang Seng | +0.18% | Neutral for UK stocks |

| Gold | +0.44% | Bearish for UK stocks |

| AUD/JPY | +0.01% | Neutral for UK stocks |

| US 10yr Yield | +46pts | Bearish for UK stocks |

Having formed a bullish pin-bar reversal candle on Tuesday, the FTSE daily rolling futures continued their recent downtrend to retest the pin-bar lows.

The market is back within the long-term support zone created by the March spike lows.

| Final Results |

| Celtic Cvpf. (CCPA) |

| Induction Heal. (INHC) |

| Interim Results |

| Dp Eurasia (DPEU) |

| Cmo Group (CMO) |

| Belluscura (BELL) |

| Dignity (DTY) |

| Cineworld (CINE) |

| Trellus Health. (TRLS) |

| Shefa Gems (SEFA) |

| Trading Announcements |

| Pennon (PNN) |

| UK Economic Announcements |

| (07:00) Current Account |

| (07:00) Gross Domestic Product |

| (07:00) Nationwide House Price Index |

| International Economic Announcements |

| (07:00) Retail Sales (GER) |

| (08:55) Unemployment Rate (GER) |

| (10:00) Unemployment Rate (EU) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.