2nd Sep 2022. 7.36am

Regency View:

Morning Report – Friday 2nd September

FTSE to open at 7,168 (+21 pts)

Stocks on Wall Street fought back from early losses to close in positive territory as economic data came in ahead of expectations…

US jobless claims hit 3-month low in a sign of robust labour market and US manufacturing activity remained steady in August as demand rebounds.

Vladimir Putin delivered a fresh threat to western efforts to curb surging energy prices. Moscow said on Thursday it would stop selling oil to countries that sought to impose a price cap on Russian oil and petroleum products.

All eyes will be on today’s non-farm payrolls number with consensus analyst estimates predicting that 300,000 jobs was added to the US economy in August.

| S&P 500 | +0.30% | Bullish for UK stocks |

| Hang Seng | -1.11% | Bearish for UK stocks |

| Gold | +0.20% | Neutral for UK stocks |

| AUD/JPY | +0.07% | Neutral for UK stocks |

| US 10yr Yield | +65pts | Bearish for UK stocks |

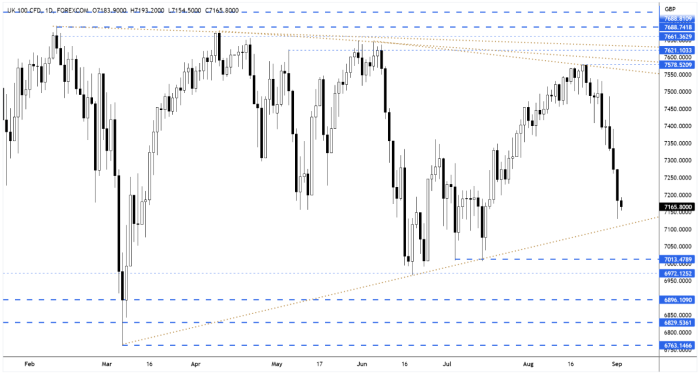

Selling pressure continued to accelerate yesterday, taking the FTSE down into the bottom of the long-term wedge pattern that has been taking shape this year.

The market is now back within touching distance of the cluster of swing lows which formed during June and July.

| Final Results |

| Time Finance (TIME) |

| Ashmore (ASHM) |

| International Economic Announcements |

| (07:00) Balance of Trade (GER) |

| (10:00) Producer Price Index (EU) |

| (13:30) Unemployment Rate (US) |

| (13:30) Non-Farm Payrolls (US) |

| (15:00) Factory Orders (US) |

Don’t have a Regency account yet?

Start receiving our actionable Market Alerts and Analysis with real-time email and SMS alerts throughout your trading day. Simply click below to create your account for free.

Create AccountAny Questions? Please feel free to call 0203 973 8007 or email us at info@regency.capital

Disclaimer:

This research is prepared for general information only and should not be construed as any form of investment advice.